Choose the Best Homeowners Insurance for You

We surveyed nearly 24,000 policyholders to find the best (and worst) home insurance companies. Plus, get expert advice on saving money and how to make sure you get the coverage you need.

Investigative Reporter

Top Homeowners Insurance Questions

What Should I Look For When Selecting a Homeowners Insurer?

-

Affordable premiums

CR’s ratings show whether policyholders were satisfied with their premium costs. (Spoiler: Most weren’t.) Start by getting multiple quotes from an independent insurance agent and compare the terms.

-

Well-handled claims

We asked homeowners how satisfied they were with how their insurer handled their most recent claim. Pro tip: Look for insurers that CR rates above average for claims handling.

-

The right coverage

We asked consumers whether they were satisfied with their policy coverage. Wise choice: Pick an insurer that provides a detailed view of your coverage—including what’s not covered—and helps determine whether it meets your needs before you sign on the dotted line.

-

Helpful customer service

How well does the company handle issues besides claims? CR’s survey asks about consumers’ satisfaction with service outside of claims handling.

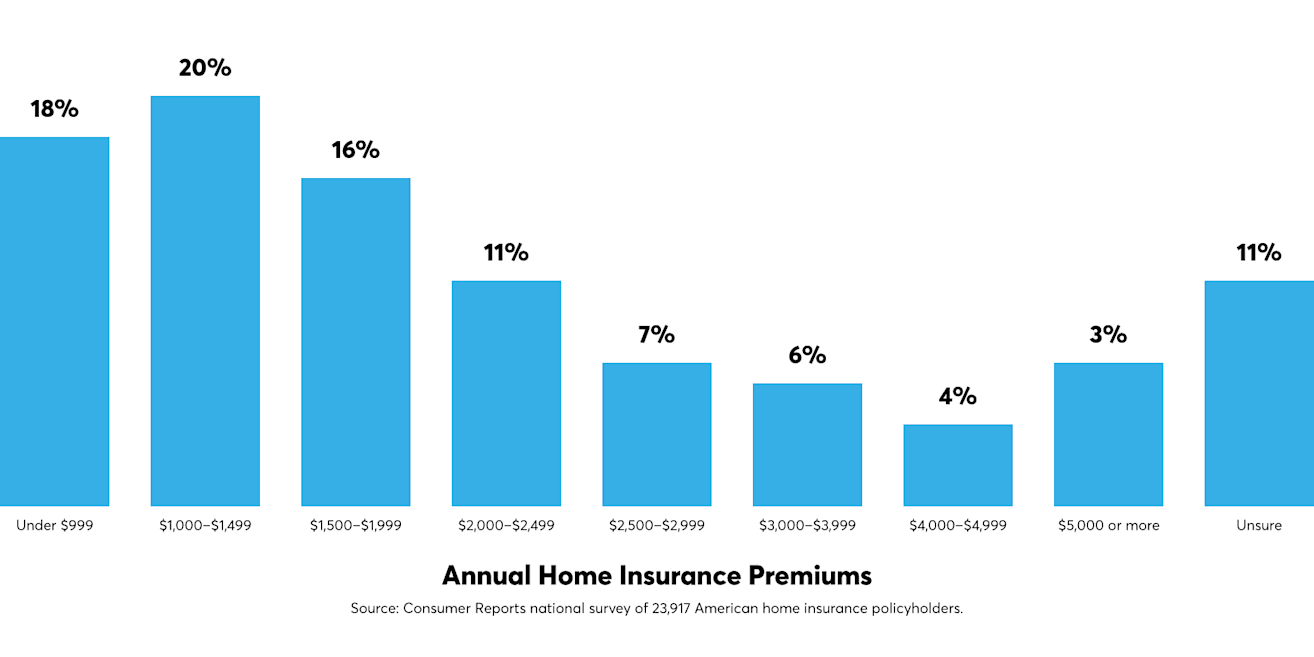

How Much Should Home Insurance Cost?

What Factors Into the Cost of Home Insurance?

-

Deductible

This is how much you must pay out of your own pocket before your insurance kicks in. You can typically reduce your annual premium by agreeing to a higher deductible. In CR’s survey, a typical deductible was $1,135. About half of policyholders reported having deductibles between $500 and $1,499.

-

The risk of disaster

If your home is in an area prone to natural disasters such as hurricanes, tornadoes, or wildfires, your premium could be higher than someone whose property is at low risk of those events.

-

Property details

The size, age, and condition of your home; the type of roof it has; and potentially whether you’ve taken any disaster mitigation steps to reduce your risk of fire, wind, or water damage could all affect your premium costs.

-

Previous claims history

Claims made for any reason, or sometimes even inquiring about a possible claim, could increase your premium costs. Not sure about previous claims? Ask your agent for a loss history report or order one for free.

What Homeowners Insurance Terms Should I Know?

- Actual cash value

- This type of policy, which covers the replacement cost of your home minus the cost of depreciation, is not usually recommended because it can leave you having to pay thousands of dollars out of pocket in the event you need to rebuild your home.

- Adjuster

- Once a claim has been made, this person estimates the damage, then makes recommendations about the settlement amount to the insurance company.

- Bundling

- The practice of offering insurance coverage by the same company for multiple things, such as both your home and your car. Doing so could earn you a discount on both policies—amounts may vary.

- Discounts

- Insurance companies may provide an array of discounts off your premium. Those could include having a security system installed, wind-resistant shutters, or even being a veteran, teacher, or over the age of 55. Ask your agent what discounts might be available for your policy.

- Exclusions

- Any event, loss, or situation, explicitly stated, such as flood or hurricane, where your home is not covered by your policy.

- Guaranteed or extended replacement

- These policies are more expensive but promise better coverage for the full cost of replacing or repairing a damaged or destroyed home. Extended replacement cost will cover 20 percent above the standard coverage, while guaranteed replacement will have no cap on the cost of rebuilding, though the coverage is pricier and less common. For more details, see What Extra Coverage Should I Consider?

- Named peril

- Explicit types of disasters that are named in your insurance policy as being included in your coverage. These can include things like tornadoes, wind, or hail, for example.

- Replacement cost value

- This policy will pay for the full cost of rebuilding your home, up to a stated limit (and no need to deduct for depreciation).

What Does a Homeowners Policy Cover?

-

Your home

Your bank or mortgage lender will likely require you to insure for at least 80 percent of the replacement value of your home in the event of a disaster such as fire, hurricane, hail, or lightning. Most policies also cover detached structures such as garages and tool sheds. (Damage due to flood, earthquake, or normal wear and tear is not covered.)

-

Your belongings

Personal items such as furniture, clothing, household goods, computers, TVs, or sports equipment are usually included in your policy, up to a stated amount.

-

Your risk (liability)

This covers you if you are held liable for someone else’s injuries on your property. Coverage typically starts at $100,000.

-

Additional living expenses

This covers rent and certain other costs associated with living elsewhere while your home is being rebuilt.

What Extra Coverage Should I Consider?

-

Extended replacement cost

A standard policy will cover replacing your home at current costs, but up to a limit. Having extended replacement cost coverage will pay 20 percent (sometimes more) above that limit if building costs increase for any reason, such as after a major disaster. Good to know: If your home has custom features, such as stained-glass windows or antique wood floors, you’ll need to purchase additional riders or buy another layer of coverage, called a restoration-cost policy, to assure those features could be replaced.

-

Inflation protection

Also called inflation guard, this provision automatically raises the coverage limit on your dwelling to reflect increases in homebuilding costs.

-

Earthquake, hail, and windstorm coverage

In our 2025 homeowners insurance survey, of those who filed a claim, the leading causes of damage in filed claims were wind and hail damage. Depending on your state, you may have to pay a separate deductible for hail damage or buy stand-alone coverage. The same is true for earthquakes and high-speed windstorms.

-

Replacement cost coverage

A standard policy may reimburse you only for the depreciated, or actual cash, value of stolen or damaged home contents. To avoid having to pay the difference when replacing possessions, pay the extra for replacement cost coverage. Document the contents of your home by making a video inventory of your possessions and store it somewhere safe, such as in the cloud or on a thumb drive kept in a safe-deposit box.

-

Personal valuables

Homeowners policies typically put dollar limits on what an insurer will pay to replace valuables such as art, antiques, musical instruments, jewelry, furs, or home-based business property. For instance, if valuable jewelry were stolen, without separate coverage you could expect no more than a few thousand dollars to replace it. So if your valuables are worth more than what a standard payout would be—check with your agent about specific items—buy a rider to supplement coverage of those costly items. In CR’s survey, 4 out of 10 policyholders said they had a separate policy for such valuable, personal items.

-

Sewer backup

This coverage would protect you if sewage backed up into your home. The cost can run from around $50 up to several hundred per year. Policy limits range between $5,000 and the full cost of replacing your home. (Unless caused by an event such as fire or a storm, your homeowners insurance policy doesn’t cover a septic system on your property.) Damage to your home from a sump-pump malfunction would be covered, too, but the pump itself isn’t covered, so you’re responsible for the cost to fix it.

Should I Get Flood Insurance?

Homeowners insurance policies will usually cover water damage only if it’s caused by a pipe or another system that breaks inside your home. Protection against flooding and mud that come from the outside must be covered by flood insurance. If you live in a high-risk flood area, you’ll probably be required to purchase flood insurance by your bank or lender. Your agent can help you with this. Most homeowners in this instance will purchase coverage from the National Flood Insurance Program.

You can quickly find out whether your property is in a flood zone by looking up your address at the Federal Emergency Management Agency. Even if your property is low-risk (identified on FEMA flood maps with the letters B, C, and X), you still may want to get coverage, which can run a few hundred dollars a year. For a more precise estimate on your premium, go to NFIP’s official site, floodsmart.gov.

One problem is that the FEMA site could be out of date for the area in which you live—some counties keep their risk maps up to date and others lag behind by several years. You can see the last time the map was updated when you look up your address.

In the meantime, you can check out FirstStreet.org and use its address lookup tool on the home page to get a free assessment of your risk. If your property is at risk, talk to your insurance agent for help getting flood coverage.

How Does Consumer Reports Rate Homeowners Insurance Companies?

Our homeowners insurance ratings—covering 28 insurance groups—are based on responses to surveys fielded from Dec. 2, 2024, to Jan. 7, 2025, of both CR members and non-members. The Overall Satisfaction Score is derived from a weighted average of seven specific attributes and our CR Consumer Experience Score. Each rating category under survey results—claims, premiums, service, advice and help, coverage, policy review, policy clarity, website, and mobile app—reflects average scores on our six-point satisfaction scale, ranging from completely satisfied to completely dissatisfied.

What Else Homeowners Need to Know

-

Worried Your Home Insurance Company Might Cancel Your Policy? Dealing With Skyrocketing Premiums? Here’s What to Do Next.

Photo: Eric Thayer/Getty ImagesEven before the January 2025 California wildfires, more and more homeowners were having difficulty finding insurance and facing extremely high costs if they did. Here’s how to protect yourself.

-

Homeowners Are Facing an Insurance Crisis. CR Thinks These 9 Basic Rights Could Help.

Photo Illustration: Consumer Reports, Getty ImagesConsumer advocates propose a bill of rights. Plus, expert tips on how to protect yourself and your home in the meantime.

-

Why Home Insurance Costs So Much—and How to Pay Less

Illustration: Chris GashBlame natural disasters, inflation, or your location. These tips will help you whittle down rising premiums.