Choose the Best Car Insurance for You

Consumer Reports' exclusive survey results and expert advice will help you save money and pick the right coverage for your needs

Senior Autos Reporter

Top Car Insurance Questions

Which Are the Best Insurers, and What to Look For

-

Low Premiums

Our ratings show whether policyholders are satisfied with the premium costs charged by major insurers. We recommend getting multiple quotes to see what’s reasonable.

-

Well-Handled Claims

Our survey asks policyholders if they’re satisfied with how insurers handle claims. Insurers with a high score are proactive and will get you back on the road as quickly as possible.

-

The Right Coverage

We ask how satisfied policyholders are with their coverage amount and how easy their policy is to understand. Will an agent review the policy to see how well it meets your needs?

-

Service and Advice

How easy is it to ask questions about your policy or get in touch with an agent? Our survey asks about satisfaction with service, help, and advice outside of filing a claim.

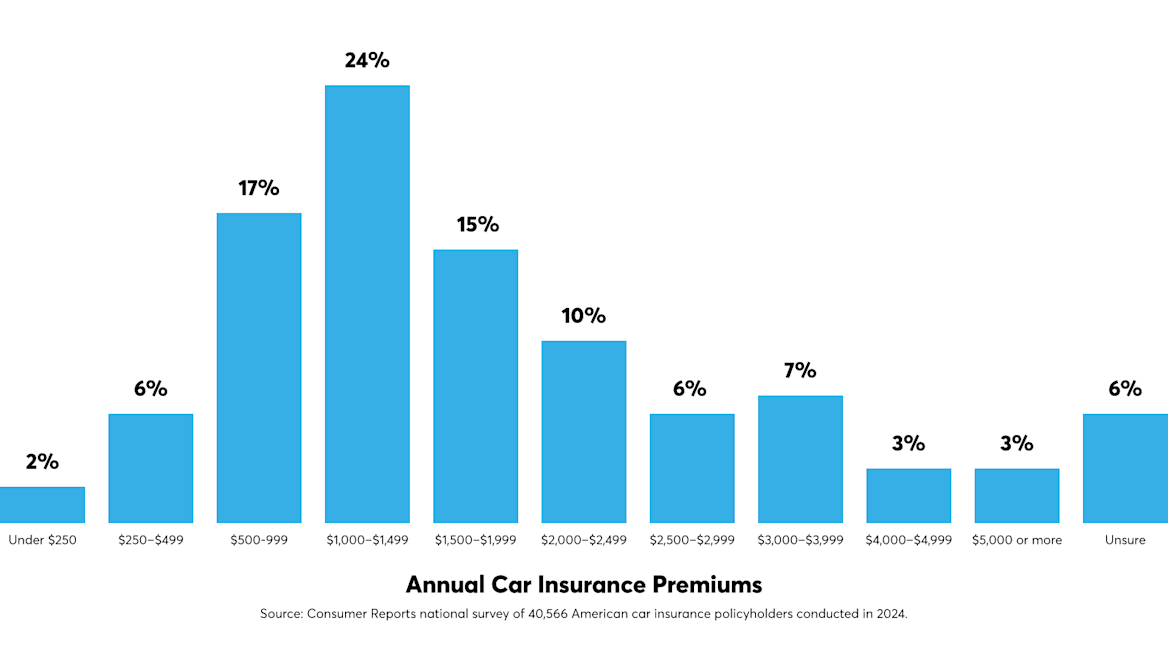

How Much Should Car Insurance Cost?

-

Where You Live

Drivers who park in areas with higher rates of theft or crashes tend to pay more for insurance.

-

What You Drive

Insurance cost depends on how much your car costs to repair or replace, how safe it is for those inside and outside the vehicle, and how likely it is to be stolen.

-

How You Drive

Drivers with little experience, who rack up tickets or crashes, or who drive lots of miles each year tend to pay more for insurance.

-

Other Factors

Young drivers usually pay more. In some states, gender, credit scores, and other factors can be used to determine your premium.

What Car Insurance Terms Should I Know?

- Adjuster

- Someone who investigates insurance claims, estimates damage, and determines who—if anyone—should pay a claim. Adjusters can work on behalf of an insurance company, or you can hire a public adjuster.

- Agent

- A person who sells insurance policies on behalf of a company or independently. They may represent one or multiple companies, and are usually paid by commision.

- Claim

- A formal request that a policyholder makes to an insurance company to pay for a loss, such as collision damage or a medical bill.

- Deductible

- The amount you must pay toward a claim before insurance pays the rest. For example, if you have a $500 deductible and a repair costs $2,000, you will pay $500 and the insurer will pay the remaining $1,500.

- Endorsement

- Also known as a rider, this modifies your policy. It usually adds additional coverage, such as to pay for a rental car while your vehicle is being repaired for a covered claim, or for roadside assistance.

- Liability Insurance

- Insurance that pays for bodily harm or property damage to a third party that was caused by the policyholder, up to the limits of the policy. Nearly all states require drivers carry at least some liability insurance.

- Limits

- The maximum amount an insurance company pays toward a claim, even if the claim exceeds the limit. If you cause $200,000 worth of damage and your policy has a $50,000 limit, you will likely be liable for the additional $150,000.

- No Fault Insurance

- Also called personal injury protection (PIP), this type of insurance is mandatory in some states and optional in others. Your own insurance company pays for your damage and medical bills regardless of fault. You may still have to pay a surcharge if you are at fault.

- Premium

- What a policyholder pays to an insurance company for coverage. You can usually pay monthly or yearly, and some insurers give a discount for paying an entire year’s premiums all at once.

- Surcharge

- An increase in your premium due to a traffic violation, at-fault crash or other claim, or policy lapse that indicates you’re a higher-risk driver. Surcharges are designed to offset higher costs of insuring riskier drivers.

What Kinds of Car Insurance Are There and What Do They Cover?

-

Liability

What It Is Pays for property damage and medical bills you cause.What It Covers Damage to another person’s car, the other party’s medical bills resulting from the crash, damage to property like a fence or lamppost, and legal fees.What It Doesn’t Cover Damage to your car from a crash where you were at fault, single-car crash damage, weather damage, theft, or vandalism.pros & cons- Lowest premium costs.

- Mandatory in nearly all states.

- Doesn't pay for many common types of damage.

- You may have to pay for bills beyond its limits.

-

Collision

What It Is Pays for crash damage to your car that’s not the fault of another driver.What It Covers Single-car crashes, at-fault crashes, hit-and-run damage, or crashes with an uninsured or underinsured motorist.What It Doesn’t Cover Damage due to weather, theft, vandalism, or hitting an animal.pros & cons- Pays to fix your car if you’re at fault in a crash.

- Pays for hit-and-run and underinsured motorists.

- More expensive than liability insurance.

- Doesn't cover theft, vandalism, and weather damage.

-

Comprehensive

What It Is Pays for noncrash damage that isn’t your fault.What It Covers Theft, vandalism, collisions with animals, hail, fallen tree limbs, and other weather-related damage.What It Doesn’t Cover Items inside your car.pros & cons- Adds coverage for noncrash damage.

- May be required on financed or leased vehicles.

- Costs more than liability and collision alone.

- May not be worth it for older cars.

What Makes Rates Go Up or Down?

Higher Rate Factors

- At-fault claims

- New driver on policy

- More coverage

- Low credit score

- High-theft ZIP code

- Loyalty

Lower Rate Factors

- Safe driving

- Low annual mileage

- Higher deductibles

- Safety and anti-theft features

- Good grades for students

- Shopping for a new policy

Can I Get a Discount for Loyalty or Bundling?

-

Switch Insurance Companies

According to CR’s 2024 auto insurance survey, 30 percent of those surveyed had switched insurers in the past five years. They saw a median annual savings of $461.

-

Take a Defensive Driving Course

In some states, you can pay a small fee to take an approved defensive driving class that can save you more than $230 on your premiums each year.

-

Bundle Your Auto and Homeowners Insurance

Some policyholders might save up to 30 percent by bundling two policies, but others may benefit from buying each policy from a different insurer.

-

Sign Up for Driver Monitoring

These programs track your driving habits and, in exchange for giving up some privacy, may help safe drivers save around $120 per year on average, according to our survey.

-

Increase Your Deductible

Raising your deductible from $500 to $1,000 could bring your premiums down by 20 to 25 percent. Just make sure you can pay the deductible if you have a claim.

-

Report Low Mileage

If you drive fewer than 10,000 miles a year, your insurer may give you an annual discount of about $115.

Teen Driver? Over 65? What You Need To Know About Car Insurance

-

Senior Drivers

Photo: Getty ImagesCR surveys show that seniors’ car insurance needs and experiences typically differ from those of other customers.

-

Teens and New Drivers

Photo: Getty ImagesBecause teens and new drivers lack experience, they tend to be riskier and more expensive to insure.

-

Bad Driving Records and SR-22s

Photo: Getty ImagesHigh-risk drivers need insurance, too. Here’s how to find a policy that covers you if you’ve had too many at-fault crashes, moving violations, or a license suspension.