If you're shopping for, say, a refrigerator, you probably start by going online to find one with the features you want and good reviews, and then compare stores to find the best price. Ever try to do the same thing when shopping for health care? Good luck.

For one thing, reliable information about quality and cost in health care has long been hard to come by. And if you do unearth that information, you might be shocked by what you find: The difference between what you have to pay can vary by thousands of dollars depending on where you live. And the quality of your care depends on which doctor or hospital you see.

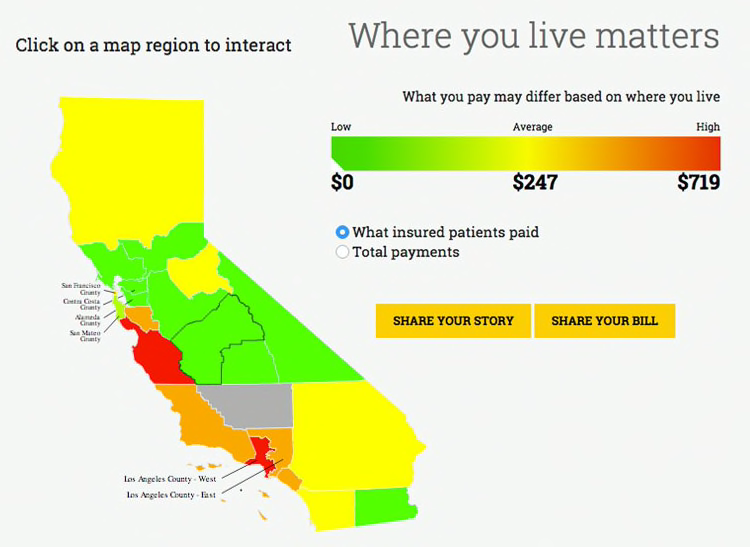

That's according to a recent analysis of insurance claims data from more than 10 million insured patients in California. Consumer Reports worked with the University of California, San Francisco, and the California Department of Insurance on the analysis, which includes payment information on more than 100 medical conditions and procedures. The information is included a new tool called California Healthcare Compare that allows patients throughout the state to estimate how much they'll have to pay for care, depending on where they live.

Below, examples of two of those procedures: C-sections and knee replacement.

C-Sections

Prices for C-sections are more than twice as high in some parts of the state than in others. In California's San Mateo County, for example, health insurers paid doctors and hospitals, on average, almost $34,000 for a C-section. But in Central San Joaquin, insurers paid doctors and hospitals only $13,000, on average.

The amount that you might pay out of your own pocket for that care can be even more variable that what insurers pay. For example, in the Monterey Coast area, patients, on average, paid more than $3,000 out-of-pocket, while in the Sacramento Valley patients paid only $152, on average. And some people had to pay much more than that, up to $14,000.

Knee Replacements

The pattern with knee replacements is similar. Insurers paid doctors and hospitals in Alameda County more than $52,000, on average, for the procedure. By comparison, in Central San Joaquin insurers paid health care providers just $21,000.

When it comes to out-of-pocket costs, at least half of people who had a knee replacement in the Sacramento Valley area didn't have to pay anything at all for the operation, while in Western Los Angeles County more than half of those with the procedure were on the hook for at least $750.

Does Paying More Mean Better Quality?

Consumer Reports' work in California also shows that the quality of the care you get varies depending on what hospital or doctor group you go to.

For example, six out of 20 rated hospitals (30 percent) in the San Francisco area received Consumer Reports' lower Rating for hip and knee replacement surgery, and eight hospitals, or 40 percent, received one of Consumer Reports' two highest Ratings for those procedures. In the Los Angeles area only four hospitals received one of Consumer Reports' two highest Ratings for childbirth, while 38 of 58 rated hospitals received a lower Rating.

You might wonder whether doctors and hospitals that get paid more provide better quality? Not necessarily. A number of studies over the years have shown than when it comes to health care, there is little if any connection between how much you or your insurance company pay and better outcomes. Instead, payments depend more on the negotiating power of the health care provider than on the quality of care.

What to Do

- Look for quality data about your doctor or hospital. If you live in California, you can use Consumer Reports' new free tool to get quality and cost information on hospitals and doctor groups for childbirth, knee replacement, back pain, diabetes care, and colon cancer screening. You can also check Consumer Reports' national tool for additional data focusing on hospital safety, and also visit federal government (Hospital Compare) and state government websites.

- Check on your costs. If you live in California, you can use Consumer Reports' new free tool to get an idea of what your costs might be for more than 100 conditions and procedures. Residents of New Hampshire and Colorado can use tools designed for their states. In addition, there are also several national tools, including Fair Health, GoodRx (for drugs), Guroo, and Healthcare BlueBook, that can help regardless of where you live.

- Get a personalized cost estimate from your insurer. The major health insurers all have tools that can provide you with a personalized estimate of your out-of-pocket costs, based on a particular provider and on the specific benefits or limitations of your specific insurance plan.