Best Car Insurance for Households Earning Less Than $50,000

Exclusive survey reveals the car insurance companies that deliver the highest satisfaction for lower-income policyholders

Car insurance is a major expense for most drivers, particularly those in households earning under $50,000 annually, where transportation costs can strain already tight budgets.

In a 2024 national survey of 40,566 auto insurance policyholders by Consumer Reports, we found that the median annual premium for households with under $50,000 in annual income is $1,128. While this is less than the overall median average of $1,452, it is still a significant hit to their budget.

To better assist lower-income drivers, we analyzed our survey data to learn more about their behavior and challenges, and then identified the car companies with the highest satisfaction among this group.

Car Insurance and Income

In CR’s survey, just over one-third (35 percent) of policyholders come from households earning under $50,000 per year. The next income bracket, $50,000 to $100,000, also comprises 35 percent of policyholders. (For context, the U.S. median household income exceeds $80,000, according to the U.S. Census Bureau.)

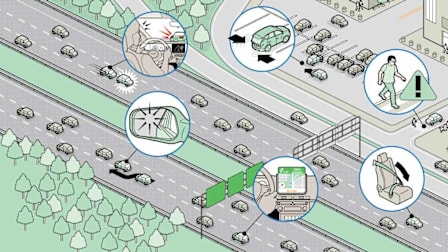

Budget constraints often lead drivers from lower‑income households to opt for state‑minimum coverage, in part because of their limited assets. But this strategy can leave them vulnerable in the event of a serious collision involving injuries, property damage, or legal liabilities.