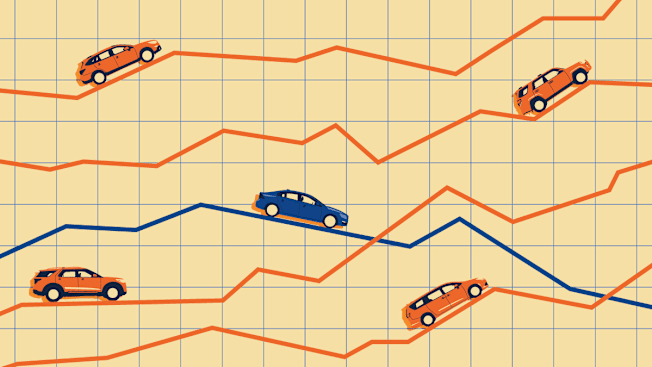

Car Insurance Companies With the Smallest Increase in Premiums

Our exclusive survey reveals the insurance providers that have limited price increases for policyholders

Car insurance premiums are going up across the U.S. This trend is being driven by the rising cost of vehicle repairs and replacements, along with car thefts and risks from severe weather. In a 2024 national survey of U.S.-based 40,566 auto insurance policyholders by Consumer Reports, 60 percent said their premiums had increased in the past year. Rate hikes were more common among older adults, white and Hispanic policyholders, and those with a four-year college degree.