Cheapest Car Brands to Insure

Some brands and body styles tend to have lower insurance premiums than others, according to data from Insurify

Budgeting for a car isn’t just about monthly payments. Other expenses, such as maintenance, repair, and insurance costs, can add up to a significant chunk of change. One way to save money is by choosing a car with a low insurance premium.

Cheapest Car Brands to Insure

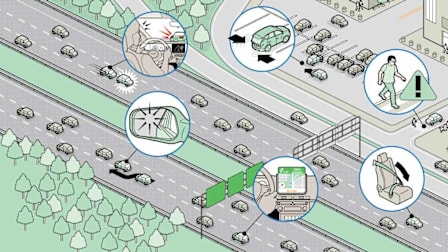

"Getting insurance quotes on a few different models before buying is a smart move, since vehicles with stronger safety ratings, proven reliability, and anti-theft features typically cost less to insure,” Robert Lee, a spokesman from Erie Insurance, told CR. “Comparing rates helps you understand potential cost differences up front and make a more informed decision.”

Shopping for Car Insurance?

See how 36 car insurance companies stack up in our car insurance ratings.

Cheapest Car Types to Insure

In addition, the style of car you drive—sedan, hatchback, SUV, pickup truck—also influences insurance premiums. According to Insurify, trucks have lower premiums than sedans and SUVs, and sedans have the highest premiums. Although all vehicle types are represented in the list of cheapest cars to insure, Insurify says the average truck costs about 16 percent less to insure than the average sedan.

More on Car Insurance

• CR’s Car Insurance Ratings & Buying Guide

• Best Car Insurance Companies

• Cheapest Car Insurance Companies

• How to Lower Your Car Insurance Rates

• Best Car Insurance Companies for Seniors

• Everything You Need to Know About Teen Car Insurance

• Proven Ways to Save on Car Insurance Even If You’re a Safe Driver

• How to Keep Your Car From Getting Stolen

• How to Prevent Catalytic Converter Theft