What Does Car Insurance Cover?

From full comprehensive coverage to minimum liability coverage and everything in between, we’ve got answers to all your car insurance questions

What exactly does car insurance cover? This is one of the most common questions we get, but the answer is surprisingly complex. It depends on the state where you live, what coverage you’ve chosen, who is driving, which insurance company you’ve chosen, and how much you’re paying. As if that isn’t confusing enough, car insurance has its own language filled with words that sound like English, but are more like legalese.

- What Is Minimum Liability Car Insurance?

- What Is Collision Insurance?

- What Is No-Fault Insurance?

- What Does ‘Comprehensive Coverage’ Mean?

- Does Car Insurance Cover Theft?

- Does Car Insurance Cover Hail or Other Natural Disasters?

- Can Car Insurance Cover Maintenance, Repairs, or Roadside Assistance?

- What Is Covered by Full-Coverage Car Insurance?

What Is Minimum Liability Car Insurance?

Liability coverage pays for damage that you cause. This includes damage to another person’s car, the other party’s medical bills resulting from the crash, damage to property like a fence or lamppost, and legal fees. If you didn’t have insurance or if you didn’t have enough insurance, you might be financially liable (another word for responsible) for these expenses.

Most car insurance policies split liability coverage into bodily injury and property damage, even though nearly all states require drivers to buy at least some of both. The least amount of insurance you can buy is called “minimum liability insurance.” It may be cheaper up front, but if you cause a crash, it could pay for as little as $25,000 in damage. Considering that medical bills can be in the hundreds of thousands of dollars and new cars often cost more than $50,000, minimum coverage may not be enough, and you may end up on the hook for the other party’s bills. We recommend purchasing more than the minimum liability coverage.

“Auto repair costs and medical expenses have been steadily increasing over the last several years, so it’s possible that the costs from a crash will exceed the limits of minimum coverage,” Bell says.

What Is Collision Insurance?

Collision insurance pays for damage to your car from a crash that’s not the fault of another driver. Collision insurance is how you pay for repair or replacement if you’re in a single-car crash, if you hit another car and the crash was your fault, or if your car gets hit in a parking lot and the other driver doesn’t leave a note. It may also be used to pay for damage to your vehicle if it is hit by a driver who doesn’t have enough insurance coverage to pay to fix or replace it. Crashes with animals usually aren’t covered under collision insurance, but they are covered under comprehensive coverage. You must buy collision insurance if your car is leased or financed.

What Is No-Fault Insurance?

Even if “no-fault insurance” might sound like a get-out-of-jail-free card, it has more to do with how insurance handles payment than assigning blame. No-fault insurance essentially means that you file an insurance claim for medical bills with your own insurer, regardless of who is at fault in the crash. Some states are considered “no-fault states,” while others allow you to purchase “no-fault” insurance, which is otherwise known as personal injury protection, or PIP. Your insurance agent can help you figure out if PIP makes sense for you.

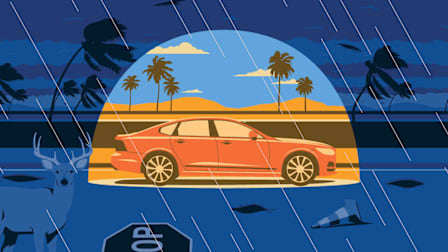

What Does ‘Comprehensive Coverage’ Mean?

Comprehensive coverage is a type of coverage you can add to an existing car insurance policy that covers damage to your car that isn’t your fault and that isn’t related to a crash. Some examples include if your car is stolen or vandalized, catches fire, or is damaged by weather. Note that crashes with animals are also covered by comprehensive coverage. In other words, if you hit a deer, it’s not a “collision” in the eyes of an insurance company. If you lease or finance your car, your lender will likely require you to purchase comprehensive coverage.

Bell says you should consider dropping collision and comprehensive coverage when your annual premiums equal or exceed 10 percent of your car’s book value, and/or the vehicle is more than 10 years old. “If you are no longer making payments or leasing the vehicle, and can afford to buy a new one or handle the cost of any needed repairs yourself, you can save on insurance premiums by essentially ‘self-insuring’ it against collision or comprehensive claims until the vehicle wears out or you buy a new one,” he says.

Does Car Insurance Cover Theft?

Not unless you have comprehensive coverage. Comprehensive coverage will pay for your car’s value if the car is stolen and destroyed or not recovered, and it will pay for repairs if the stolen car is recovered with damage. Car insurance usually doesn’t cover items that are stolen out of your car, but they may be covered by your homeowners or renters insurance policy. Learn how to keep your car from being stolen.

Does Car Insurance Cover Hail or Other Natural Disasters?

Only if you have comprehensive coverage. Drivers in high-risk areas for major storms and flooding should add comprehensive coverage.

Can Car Insurance Cover Maintenance, Repairs, or Roadside Assistance?

In general, the answer is no. Some car insurance companies also sell extended warranties that they market as “mechanical breakdown insurance.” These warranties can cover some unexpected car repairs, but despite their confusing names, they are unrelated to traditional car insurance. Many car insurance companies also offer roadside assistance, as either a free perk or a benefit that you have to pay extra for.

What Is Covered by Full-Coverage Car Insurance?

When people say “full coverage,” they usually mean a policy that includes liability, collision, and comprehensive coverage. Your insurance agent might also use this term, but it’s not officially used in policies. To get full coverage, you’ll have to add comprehensive and collision coverage.

More on Car Insurance

• CR’s Car Insurance Ratings and Buying Guide

• Best Car Insurance Companies

• Cheapest Car Insurance Companies

• How to Lower Your Car Insurance Rates

• Best Car Insurance Companies for Seniors

• Best Car Insurance for Households Earning Less Than $50,000

• Everything You Need to Know About Teen Car Insurance

• Proven Ways to Save on Car Insurance Even if You’re a Safe Driver

• How to Keep Your Car From Getting Stolen

• How to Prevent Catalytic Converter Theft