Behind The Scenes

Summer 2023

Thank you for making a big difference for consumers! We’re excited to share how your support helped Consumer Reports advocate for safer food, better protections for peer-to-peer payment apps, and advancements in car safety testing by expanding opportunities at our famed auto test track.

Here’s a look at your impact at work.

New State-of-the-Art Track at CR’s Auto Test Center

On May 4th we unveiled a new 1.5-mile loop that will allow us to test advanced auto technology such as adaptive cruise control on curves, hills, split lanes, lane merges, and exit ramps. More than half of new cars today come equipped with advanced driver assistance systems (ADAS) features that enable them to automate certain driving functions with little to no driver intervention. While these systems have the potential to make driving safer, CR has found that not all are created equally, and lack of public awareness of their limitations can be dangerous.

With the addition of the new ADAS Loop at our Auto Test Center in Connecticut, CR now has six miles of paved test roads to evaluate the latest auto technologies and expand our longstanding work to advocate for the safety of drivers and pedestrians.

CR Advocates for Safer Food

Part of staying healthy is keeping up to date on food recalls. CR’s food safety experts investigated the foods most often linked to foodborne illnesses. They ranked the recalls mainly on how many people died or became ill, as well as how widespread the outbreaks were, how many times a food was recalled, and the total amount of food recalled. Read the report and their tips on what to be aware of when grocery shopping.

“We aren’t saying people need to avoid these foods entirely,” said Brian Ronholm, director of food policy at CR, who led the analysis. “After all, these foods are all usually safe, and many of them are in fact important parts of a healthy diet.” Instead, he says, the list underscores the “importance of following best food safety practices with all of your foods, including knowing how to track, and respond, to food recalls when they happen.”

As a CR member you can sign up for food safety alerts here.

Better Protections to Send Money Safely

Nearly two-thirds of us use a peer-to-peer (P2P) payment app to send money to other individuals, according to a nationally representative CR survey of 2,116 U.S. adults in March 2022. To uncover issues that affect people’s everyday finances, CR evaluated four popular P2P apps: Apple Cash, Cash App, Venmo, and Zelle. We found that, while these apps offer convenience, users can lose money to fraud and scams. They also face privacy risks because app providers may share their personal information widely, and it’s hard to delete personal data. CR’s report was widely covered by the media, including in this New York Times article.

We are engaging leaders in the federal government and financial industry to adopt stronger policies and safeguards to minimize user risks so that consumers have better protections.

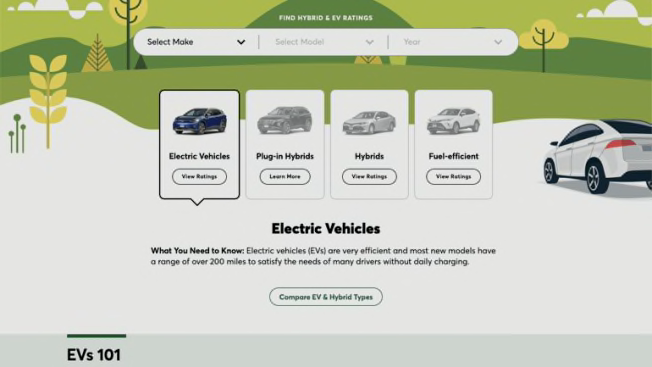

Car Buying Resources for CR Members

CR’s new online EV and hybrids hub provides CR members with a one-stop source to compare the most fuel-efficient vehicles side-by-side. Visit the hub for unbiased information, whether it’s understanding which federal and state tax incentives are applicable, looking at the pros and cons of EVs, hybrids, plug-in hybrids, and the most fuel-efficient gas-powered cars, comparing each type, or keeping up with the latest news. Only CR members can use our comparison tool with ratings.

If you’re interested in shopping for an electric vehicle, try CR’s EV Incentive Finder, our online tool to search for the latest information on federal, state, and regional buying incentives for EVs.

Meet Kristen Purcell

As Vice President, Chief Research & Analytics Officer at CR, Kristen leads a team that works with consumers, including our members, to ensure that CR’s products, services, advocacy, and business strategy are meeting the needs of people today. Previously, she worked at the Pew Research Center and Mathematica Policy Research.

Q: What brought you to CR?

I started at CR a little over four years ago. I knew the brand, of course, and jumped at the opportunity to work at another mission-driven organization. My background is in social policy research, and I’ve always worked at nonprofits whose goal is to use rigorous research and data to improve people’s lives.

Q: What do you do in your role at CR?

I lead the Research & Analytics Division, which includes Survey Research, Statistics & Data Science, Consumer Experience & Usability, Consumer/Customer Data & Intelligence, and Data Acquisition & Partnerships. We work with virtually every part of CR, providing data and analytics for product ratings, business strategy, advocacy and impact, content, and digital experience. We are the voice of the consumer within CR, in the form of insights around what today’s consumers (members and non-members alike) care about, where their pain points are, how they experience products and services in the marketplace, and what kind of experience they want CR to provide.

Q: What are one or more exciting initiatives you’re working on that CR donors make possible?

There are so many! Our team focuses on making CR as data-driven as possible. This past year, that included the Survey team working on expanding CR’s service ratings (look for new pet insurance ratings). The Statistics & Data Science team is doing some groundbreaking work developing a predictive modeling tool that combines multiple data sources to help CR see into the future of consumer trends and be ready with the content and product information consumers need at exactly the right time. The Consumer Experience & Usability team is working with the Auto Test Center on EV usability research, critical for the burgeoning EV market, and we introduced CR’s first ever Director of Data Acquisition & Partnerships to drive the use of more external data in our work.

My favorite project this year has been a multi-phase study that several parts of the team are working on together, which we call the “Expert Review” research. It builds on the research identifying new target audiences by taking a deep look at what these audiences are looking for when they purchase a CR membership. We started with discussion boards in which consumers shared what “independent, expert product reviews” are to them and how CR can make them as valuable as possible. We then conducted in-depth, video interviews to learn more about the research process today’s consumers employ to learn more about where and how CR can be most useful, and now are wrapping up with a consumer experience study in which participants look at different ways CR currently provides product information and help, along with some potential new offerings, to help us learn more about what best meets their needs and expectations. In a quickly changing world, it’s so important to take a step back regularly and let consumers tell us what they want and need.

Q: How does your team contribute to powering CR’s work to improve consumers’ lives?

By providing data and insights on what consumers do, think, and feel, we try to ensure that CR’s products, services, advocacy, and business strategy are all meeting the needs of today’s consumer. We carefully track and predict consumer and market trends so CR can anticipate what kinds of information and products consumers will need and when they will need them. We also regularly gather data on consumer concerns around broad social issues like data privacy, sustainability and climate change, trust in financial institutions, the impact of inflation, and the safety of the country’s food supply to determine where CR can have the greatest impact on issues that matter most to consumers.

Q: What changes would you like to see in the marketplace that would benefit consumers?

Given our recent focus on growing our service provider ratings (internet services, homeowners insurance, auto insurance, etc.) I’m seeing the very real impact of service monopolies and unfair pricing practices in our consumer surveys. In so many areas in the U.S., consumers have little to no choice of internet service provider which means they have no real leverage to demand reasonable prices and quality service. On the insurance side, there are parts of the country where many home insurers have pulled out altogether and many of the biggest auto insurers continue to use non-driving factors to determine premiums. Real competition and transparent pricing practices are critical to ensure consumers have access to the services they need at an affordable and fair price.