One Year After the Fire, Crisis Still Looms

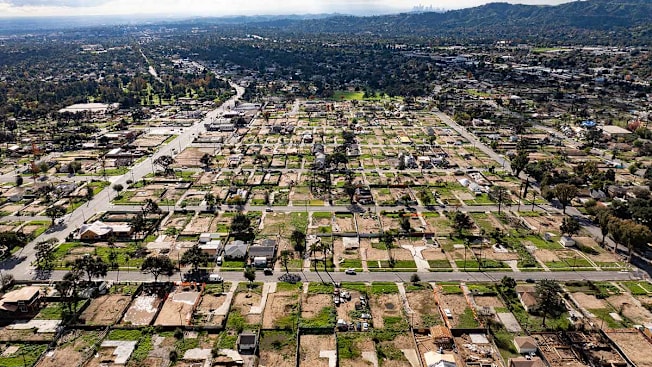

In fire-devastated Altadena, residents battle to rebuild their homes and restore their community

For generations of Black residents, Altadena represented an on-ramp to the American Dream of homeownership. In the past year since the devastating Eaton fire tore through this community in Los Angeles County, it has been an avatar of the destructive force of extreme weather conditions.

Today, what happened in Altadena raises questions: Will those who lost their homes to the fire be able to rebuild? And how is the ongoing homeowners insurance crisis playing out in areas hard hit by wildfires or other natural disasters?

I recently visited with a handful of Altadena residents in the run-up to the fire’s one-year anniversary to discuss the challenges and hard decisions they’re facing in answering those questions.

I spent a lot of time with Alponso Browne, a 30-year-plus resident. The 1912-built Craftsman-style home that he and his family shared since the 1990s was completely destroyed on the first night of the Eaton Canyon Fire in January 2025, just one month after their homeowners insurance nonrenewal took effect.

Remain, Recover, Rebuild Altadena

An up-close look at the homeowners insurance crisis.

Altadena resident Alphonso Browne gave CR's Brian Vines a tour of the remains of the house he lost to the Eaton Fire.

Protecting Your Home

If you find yourself caught in what consumer and industry observers alike have characterized as a full-blown homeowners insurance crisis, these strategies and resources from Consumer Reports could help:

- "Worried Your Home Insurance Company Might Cancel Your Policy? Dealing With Skyrocketing Premiums? Here’s What to Do Next." offers tips on how to fight a nonrenewal or find alternative insurance.

- "Best (and Worst) Homeowners Insurance Companies" is our exclusive ranking based on CR’s survey of nearly 24,000 policyholders.

- CR’s homeowners insurance ratings let you dig into the data to compare 28 different companies across a range of factors, including policyholder satisfaction with the cost of premiums, recent claims processes, customer service, and more.

- CR’s homeowners insurance buying guide offers advice and answers on everything from how to find a good insurance company to how much coverage you actually need.