Why Renters Need Renters Insurance

Easy to get and relatively inexpensive, this coverage protects your belongings and limits your liability

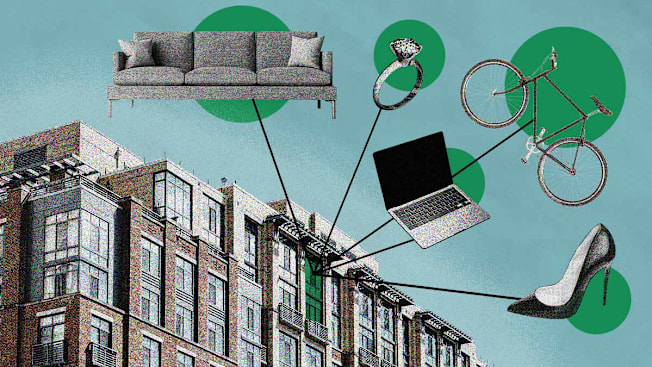

One of the advantages of renting is not having to insure the building itself—that’s your landlord’s responsibility. But the belongings you bring into that rental, including your furniture, dinnerware, pots and pans, and electronics, are your responsibility.

“We never really consider what it would cost to replace the clothes, books, household items, and everything else we’ve accumulated over the years if someone broke into our apartment or the stove caught fire while we were making dinner,” says Franklin J. Manchester, a strategic advisor specializing in insurance at the data firm SAS Global Industry Marketing. Not having insurance can make replacing those possessions extremely costly if they’re damaged or stolen, Manchester says.

What Rental Insurance Does, and Doesn’t, Include

| Most Renters Insurance Policies Cover: | Most Renters Insurance Policies Won’t Cover: |

| Personal possessions: Clothes, books, jewelry, electronics, furniture—basically anything that you bring into the rental is protected from loss due to a covered event. | The building itself: If you didn’t move an item into the unit, it’s typically not covered. That could include things like built-in lighting and bookcases, and large appliances. |

| Liability protection: Protects you in case someone gets hurt in your home and sues you or if you cause a fire or major damage to the dwelling. | Valuable items: Some policies limit coverage on individual items to as little as $2,500, which means your wedding ring or new high-end laptop may not be fully covered. You can usually increase coverage limits or buy separate coverage to insure expensive items. |

| Most disasters: Coverage usually includes damage from fire, smoke, lightning, thefts, vandalism, explosions, windstorms, and some types of water damage. | Flood or earthquakes: Renters insurance generally does not cover these perils. An insurance agent or broker can let you know what coverage is available if you’re located in a flood or earthquake-prone area. |

| Additional living expenses: Provides money for a place to stay while your rental is being repaired after a disaster. |

How to Find the Best Renters Insurance for You

Before you start shopping for policies, first do a home inventory to give you an idea of how much coverage you actually need—and help you avoid paying for coverage you don’t. It will also help you make a claim if your stuff is stolen or damaged.

Just make sure to keep it in a safe place, or in the cloud. Emily Rogan, a senior program officer with United Policyholders, a nonprofit insurance information organization, recommends taking photos or videos of all of your belongings since those are good memory joggers should you need to file a claim.

Once that’s done, move on to the following steps:

Bundle if you can. If you already have an auto or life insurance policy with a company you like, the easiest way to get a rental policy may be to contact the provider and ask to bundle it with an existing policy. Doing so will also likely earn you a discount of about 5 percent to 10 percent off your annual premium, says financial planner and CEO of Concierge Financial Advisory, Constance Craig-Mason.

Consult an independent broker. You can also purchase renters insurance from an insurance broker, who can help you shop for a policy, answer any questions you have, and help you file a claim if you ever suffer losses. Independent agents and brokers typically work with multiple insurers instead of just one or two companies. Find one by searching with your zip code at trustedchoice.com.

Contact companies directly. You can shop for policies by calling or visiting the websites of major insurance companies, such as Geico, Progressive, and State Farm. However, comparing prices and coverage between companies can be a time-consuming process.

What Your Policy Should Include

No matter how you decide to purchase your policy, be sure to keep the following advice in mind:

Insure for replacement cost, not actual cash value. Actual cash value is how much a possession is worth after depreciation is factored in; replacement cost is what it would cost to buy that possession today. You’ll save money on your premium by insuring for the actual cash value of your belongings, but you’ll end up paying a lot more if you suffer a loss and need to replace your belongings.

Shavon Roman, a licensed insurance agent and founder of the financial consulting company Heal. Plan. Invest., says to think of it this way: If you bought a TV for $500 two years ago, a policy paying out actual cash value may only give you $15 because of how much that model has depreciated. But if your policy pays out the replacement cost, you’ll get enough money to buy a brand-new model the same size as your old one.

Get separate coverage for valuable items. Policies typically cover individual items only up to a certain amount (often $1,000 to $2,500 per item). In 2010, before she became an insurance agent, Roman learned this the hard way. After her apartment was broken into and her valuables were stolen, her renters insurance policy covered most of her losses, but reimbursed only $2,500 for her $12,000-plus engagement ring. She says that adding a rider to your renters policy to cover expensive items such as jewelry and computers might add a few extra bucks to your premium, but is well worth the cost.

Keep roommates on separate policies. Though it’s possible to be listed on the same policy as your roommate, experts we spoke with said they’d recommend keeping separate policies. “Property is not usually owned by multiple roommates, so it’s just cleaner to have separate policies,” says Craig-Mason.

Look for discounts. Most insurance companies offer discounts based on several criteria. They can vary by company, so it pays to ask. For instance, consider paperless billing and paying annually rather than monthly. Also, having safety features in your rental can translate to savings, such as security systems, smoke detectors, or deadbolt locks. Having good credit scores, having a long history with a company, being over the age of 55, or setting a higher deductible can help with discounts as well.

When to File a Claim

According to an August 2025 nationally representative CR survey of 2,152 adults, 9 percent of consumers with renters insurance said they had filed a claim in the last three years (PDF).

You might think you should file a claim any time you experience a loss. But it’s not necessarily that simple. First, file a police report if the loss was due to theft: You’ll need the report to file any claim.

Next, check the policy’s deductible. If the amount of the loss is less than the deductible, there’s no point in filing a claim, says the III’s Friedlander.

If the amount of the loss exceeds the deductible, you will want to file a claim. It might lead to higher premiums, but Friedlander says that the impact is typically minimal since renters insurance premiums are relatively modest to begin with.