Sign In

Menu

Suggested Searches

Recent Searches

Suggested Searches

Product Ratings

Resources

Chat With AskCR

Resources

All Products A-ZThe payment for your account couldn't be processed or you've canceled your account with us.

Re-activateMy account

Sign In

My account

Sign In

The revival of a defunct, Depression-era law that split banks' commercial and investment-banking functions is getting support from many advocacy groups that contend the divide is needed again to protect consumers.

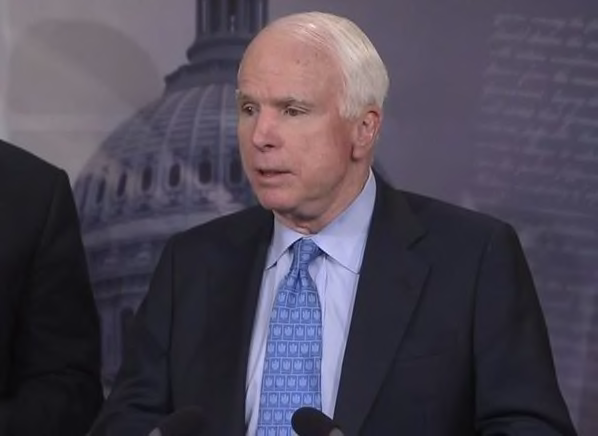

Today, on the 81st anniversary of the signing of the Glass-Steagall Act of 1933, a group of consumer advocacy groups including Consumers Union, the policy and advocacy arm of Consumer Reports, urged senators to sign on to the 21st Century Glass-Steagall Act (S. 1282), a bill introduced last summer and co-sponsored by a bipartisan Senate group including Elizabeth Warren (D-Mass.), John McCain (R-Ariz.), Angus King (I-Maine) and Maria Cantwell (D-Wash.).

The bill would require banks to separate their commercial lending arms, which provide loans to businesses and consumers, from their investment-banking arms, which underwrite and trade assets on financial markets. Commercial banks, which protect their deposits with Federal Deposit Insurance, would not be permitted to engage in speculative trading, market-making and other risky activities. Investment banks would not be permitted to obtain federal insurance for their deposits. Among other goals, the bill is intended to prevent banks that act irresponsibly from getting public bailouts, as occurred during the banking crisis of 2008.

Read more on investing at the Consumer Reports investing center.

"Insured lenders would have to make money by successfully lending to nonfinancial businesses, rather than by using their funds to engage in speculative trades that benefit only the banks themselves and their most highly paid traders and executives," said a letter signed by 162 organizations, including 33 national groups such as the AFL-CIO, Consumers Union, Public Citizen, and U.S. Pirg. "By requiring banks to focus on lending to the real economy, the 21st Century Glass-Steagall Act would also help create a banking system that better serves consumers, small businesses and the overall economy."

The Glass-Steagall Act of 1933, also known as the Banking Act of 1933, created such a bank separation. It was among a series of financial reforms designed to prevent the type of financial excesses that helped cause the Great Depression. In the 1980s, in a wave of anti-regulatory activity, lawmakers began dismantling the law. It was officially repealed in 1999.

—Tobie Stanger

Build & Buy Car Buying Service

Build & Buy Car Buying Service

Save thousands off MSRP with upfront dealer pricing information and a transparent car buying experience.

Get Ratings on the go and compare

Get Ratings on the go and compare

while you shop