Sign In

Menu

Suggested Searches

Recent Searches

Suggested Searches

Product Ratings

Resources

Chat With AskCR

Resources

All Products A-ZThe payment for your account couldn't be processed or you've canceled your account with us.

Re-activateMy account

Sign In

My account

Sign In

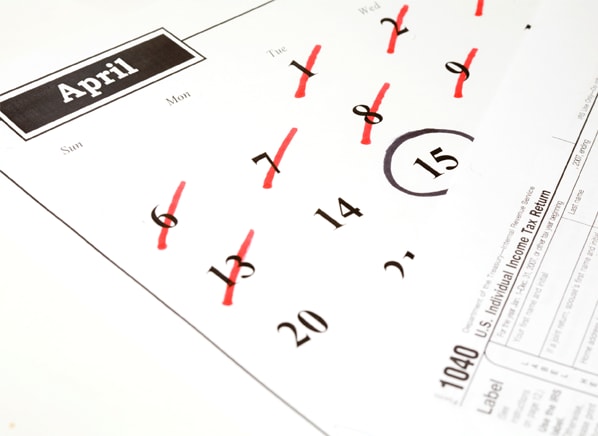

With just a few weeks left of tax-season 2015, here are a few actions worth taking to save you money on 2014 taxes, jumpstart savings for you or a relative, or possibly get a tax break on health coverage for 2015.

• Contribute to an IRA. You have until April 15 to contribute to a 2014 traditional IRA, potentially reducing your taxable income. The maximum deductible contribution is $5,500 for those under age 50 and $6,500 for those age 50 and older. Your deduction will be limited based on income and whether you or your spouse has a retirement plan at work. Do you own a small business? Then you might be eligible for higher income and contributions limits through a simplified employee pension (SEP) IRA. Go to irs.gov and search for IRS Publication 590, "Individual Retirement Arrangements," for details on contributions and income limits.

• Contribute to the IRA of a young relative or someone else starting out. Lower-income workers of all ages will benefit in three ways: more savings, less taxable income, and, if they're not medically insured through your plan or one at work, a larger insurance premium tax credit.

• Apply for health-insurance coverage. Taxpayers in states with state-run health-insurance Marketplaces who didn't realize they would owe a penalty for lack of coverage in 2014 can take advantage of extended sign-up periods for 2015 coverage, through April 17 or even later. They may find themselves eligible for income-based tax credits to use toward premiums.

—Tobie Stanger (@TobieStanger on Twitter)

Visit Consumer Reports' Tax Guide for wisdom on preparing, paying, and saving money on your taxes

This article also appeared in Consumer Reports magazine.

Build & Buy Car Buying Service

Build & Buy Car Buying Service

Save thousands off MSRP with upfront dealer pricing information and a transparent car buying experience.

Get Ratings on the go and compare

Get Ratings on the go and compare

while you shop