Why an 84-Month Car Loan Is an Expensive Risk

Long loans can lower your monthly payment, but you'll end up paying more

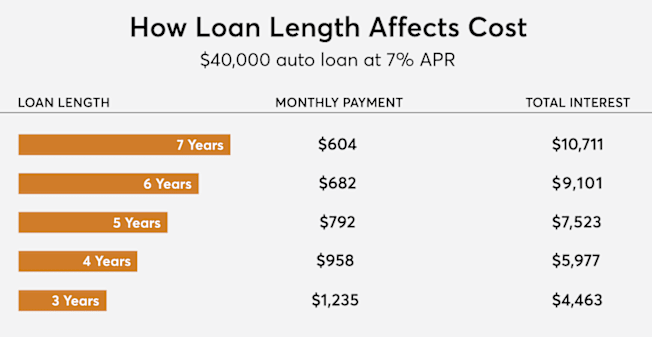

The average new-car price has been hovering near $50,000 for a while. For many buyers, this means finding a car within their budget can be a challenge, especially with the average new-car loan interest rate at 7 percent and the used-car rate at nearly 11 percent, according to NerdWallet.

For these reasons, consumers are paying more than ever in recent history to purchase and finance a vehicle. One way to keep monthly costs down is by taking out a very long loan. Recently, 84-month and even 96-month loans have become more common. But before you go out and sign a seven- or eight-year commitment on a car, Consumer Reports’ experts advise looking at the numbers.

Rapid Depreciation

Some cars depreciate faster than a loan can be paid down, especially over many years. That means there could be a period when you owe more than your vehicle is worth, also known as being underwater or upside down. If the car is stolen or totaled in a crash, that could mean a financial disaster.

Long Loans Aren't Less Expensive

“We know there are layers to vehicle ownership, from people who flip leases on new vehicles to people struggling to afford the payment of a subprime ‘buy here, pay here’ loan on an 8- to 10-year-old vehicle,” Nana-Sinkam says, adding that most new vehicles that are sold—as opposed to leased—end up being traded in as used cars four or five years later.

Bell says stagnant household incomes, rising vehicle prices, and higher interest rates on loans are the main reasons automobile ownership is taking a bigger bite out of people’s monthly budgets. And as CR has said before, the cost of car ownership usually exceeds monthly payments on a loan.

“Stretching out the payments doesn’t make the car itself more budget-friendly if you take the longer view,” he says. “It’s sort of like the frog in the pot of lukewarm water that is gradually heating up. You don’t notice the change year over year, but if you step back and look at what is happening to consumer household budgets, you see many people really straining to keep up with the rising costs of vehicle ownership.”

Sometimes a long loan can stretch out, further increasing the risk of negative equity. For example, if you’re having trouble making loan payments, you may qualify for a payment deferral plan, Bell says. When they’re approved by a lender, deferral programs delay the onset of financial responsibility by several months if you’re experiencing employment instability. Keep in mind, though, that the vehicle continues to depreciate while you’re not making payments. Nana-Sinkam says that even though a payment deferral delays paying off a loan and can increase the total amount paid, three months isn’t likely to make a significant difference.

Two Types of Buyers

Nana-Sinkam says low-interest, long-term loans will mainly appeal to two very different types of buyers: the “buy and hold” shopper who plans to drive the car until the wheels fall off, and the “three-digit” shopper whose financial situation puts them at the mercy of the monthly payment amount.

“There is some meaningful part of the American consumer body that consistently has to pass on financial strategies they know are ‘smarter’ in order to make ends meet,” he says. “Over 60 percent of the American public does not have enough money in the bank for a $500 emergency. That’s uncomfortable, but it’s true.”

Bell says consumers should give themselves budgetary breathing room to free up money for longer-term investments.

“I think consumers are better off when they take a hard look at the rising cost of new cars and are more conservative in the percentage of income they want to devote to car payments and the total cost of car ownership,” he says. “Super-long loans are not a great idea, even if it seems a lot of people are doing it. Unless you can come up with a really large down payment, you will owe more than the car is worth for many years to come.”

Not sure if you’re the “buy and hold” type? Nana-Sinkam offers advice on how to figure that out before you commit by asking the dealer to see a 3- or 4-year-old version of the model you intend to buy.

“Sit in it and drive it and imagine that the new one you buy will be 3 or 4 years old at some point,” he says. “This is what it will drive like and look like and smell like. Will you still be excited about it and happy you bought it? If the answer isn’t ‘heck yeah,’ then recognize that you might get an itch in the middle of a six- or seven-year car loan that is going to be hard to scratch because of that negative equity.”

The key to buying a car that will serve you for many years to come is to take your time, check the road tests and reliability information available at CR.org, and take your time with test drives. Buying a car is a big decision that can have a far-reaching financial impact.

CR's Build and Buy Car Buying Service

In addition to research and reviews, Consumer Reports offers members access to the Build & Buy Car Buying Service at no additional cost. Through this service, members can compare in-stock vehicles, see what others paid for the car they want, and customize their payments online. Once they find the vehicle they’re interested in, members can get up-front price offers online from local certified dealers. On top of national incentives, Consumer Reports members are eligible for additional incentive offers from select manufacturers through the Build & Buy Car Buying Service. Plus, members can get an instant trade-in value for their current vehicle to use toward their next car purchase.

More on Car Insurance

• CR’s Car Insurance Ratings and Buying Guide

• Best Car Insurance Companies

• Cheapest Car Insurance Companies

• How to Lower Your Car Insurance Rates

• Best Car Insurance Companies for Seniors

• Everything You Need to Know About Teen Car Insurance

• Proven Ways to Save on Car Insurance Even If You’re a Safe Driver

• How to Keep Your Car From Getting Stolen

• How to Prevent Catalytic Converter Theft