Sign In

Menu

Suggested Searches

Recent Searches

Suggested Searches

Product Ratings

Resources

Chat With AskCR

Resources

All Products A-ZThe payment for your account couldn't be processed or you've canceled your account with us.

Re-activateMy account

Sign In

My account

Sign In

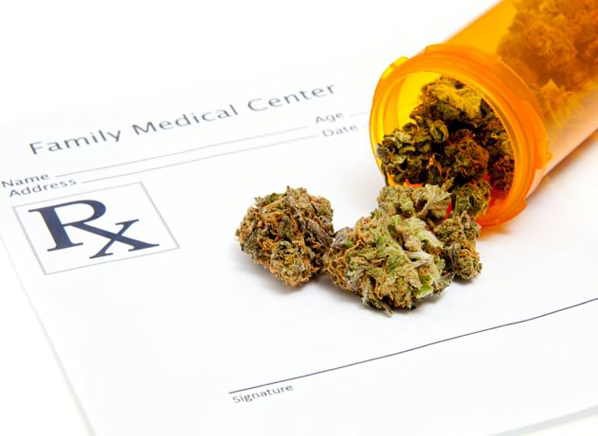

Twenty-three states and the District of Columbia have legalized medical marijuana, but its users still can't deduct it as a medical expense on their federal income tax returns.

Marijuana is still considered illegal in the United States, and the IRS clearly says that medical marijuana doesn't qualify for a federal tax deduction. So, there's no way to report that expense as a way to reduce your adjusted gross income and taxable income.

See our Income Tax Guide for advice and tips on preparing, filing, and saving on your return.

How about at the state level? If you live in a state where medical weed is legal, could you deduct that expense off of your state return? Probably not, says Barbara Weltman, an attorney and contributing editor to J.K. Lasser's "Your Income Tax" book series. "Many states follow federal rules—using federal adjusted gross income for the basis of state income tax—so it wouldn't be deductible in these states," she said. But, she continued, it doesn't hurt to check directly with your state's taxing authority.

There are lots of other interesting medical expenses that you probably didn't even realize were deductible, including mattresses, service animals, wigs, and home improvements (for general guidelines, check IRS Publication 502, Medical and Dental Expenses). But unless you have many such expenses, they may not help you save money on your tax return. You can only deduct that portion of your medical expenses that exceeds 10 percent of your household adjusted gross income (7.5 percent when at least one of the filers is 65 or older, through tax-year 2016).

—Tobie Stanger

Build & Buy Car Buying Service

Build & Buy Car Buying Service

Save thousands off MSRP with upfront dealer pricing information and a transparent car buying experience.

Get Ratings on the go and compare

Get Ratings on the go and compare

while you shop