Sign In

A good health care plan should provide high overall quality and help members avoid unnecessary medical care. That can help cut health care costs and reduce the risks that come with all medical tests and treatments. (Read more about the outrageous costs of health care in this country).

The PDF chart linked to here shows rankings for all private plans (those you buy on your own or get from your employer) in each state plus Puerto Rico and Washington, D.C, and also identifes plans that earned our check mark in Avoiding Overuse. The data come from the National Committee for Quality Assurance, a nonprofit quality measurement and accreditation organization. (See the full rankings of health insurance plans, including Medicare Advantage and Medicaid plans.)

To earn a check in Avoiding Overuse, plans must have sufficient data, score higher overall, and do better in at least three of these areas:

Our analysis found that in general, preferred provider organizations (or PPOs, which allow you to see out-of-network providers, but at higher cost), did not perform as well in Avoiding Overuse as health maintenance organizations (HMOs, which only cover in-network providers and usually require you to get a referral from a primary-care doctor). We also looked at which health insurance companies had the most plans overall that did well in Avoiding Overuse, and where those plans tended to be situated in the U.S. (see below).

We looked at large insurers that offer multiple health plans to see how they compare when it comes to avoiding overuse. The table shows the percentage of NCQA-ranked private plans for each insurer that earned a checkmark for Avoiding Overuse.

Insurance company name |

Percentage of plans with a check mark in Avoiding Overuse

|

Kaiser Foundation Health Plans, Inc. |

67% (6 of 9) |

| Independents | 30% (31 of 103) |

Blue Cross and Blue Shield Association |

27% (14 of 51) |

CIGNA HealthCare, Inc. |

21% (21 of 101) |

Coventry Health Care, Inc. |

17% (3 of 18) |

Aetna Health, Inc. |

8% (5 of 65) |

UnitedHealthcare Corporation |

6% (6 of 108) |

Health Net, Inc. |

0% (0 of 4) |

Humana, Inc. |

0% (0 of 26) |

Wellpoint, Inc. |

0% (0 of 22) |

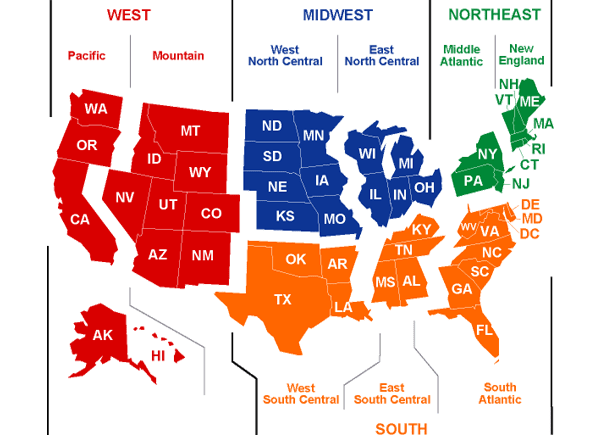

We looked at private health insurance plans across the country. In nearly half of the states, not a single plan received our checkmark for Avoiding Overuse, while in some states—notably Minnesota and Massachusetts—at least half earned that designation. Overall, plans in the Northeast outperformed those in the rest of the country.

Region |

Percentage of plans with a check mark in Avoiding Overuse |

Northeast |

33% (40 of 121) |

West |

13% (14 of 111) |

| Midwest | 12% (16 of 136) |

South |

10% (16 of 162) |

Overall score. Each plan gets a score from 1 to 100, based on how well it provides preventive services, including cancer screenings and immunizations; how well it manages chronic diseases, such as heart disease; consumer satisfaction; and accreditation. The overall score is also used to determine a plan's national rank, shown in the far left column of the chart.

Consumer satisfaction. This indicates how well a plan performed in a survey of members about such factors as getting timely doctors' appointments, getting the care they need, and their overall assessment of their doctors and specialists.

Prevention. This measures the proportion of eligible members who received preventive services, such as prenatal and postpartum care, cancer screenings and immunizations. It also looks at access to primary- and preventive-care visits for children and adolescents.

Treatment. This measures the proportion of eligible members who received the recommended care for people with conditions such as asthma, diabetes, heart disease, alcohol and drug dependence, and mental illness.

Accreditation. Most plans in the rankings are accredited by the NCQA, which requires plans to consistently show high-quality care, strategies for improvement, and public disclosure. Plans pay fees to any organization that evaluates them, including NCQA.

Read more about how health insurance plans are ranked.

Click on the image at right for rankings of health insurance plans nationwide. Use the tool to:

This article also appeared in the November 2014 issue of Consumer Reports magazine.

Build & Buy Car Buying Service

Build & Buy Car Buying Service

Save thousands off MSRP with upfront dealer pricing information and a transparent car buying experience.

Get Ratings on the go and compare

Get Ratings on the go and compare

while you shop