Sign In

Menu

Suggested Searches

Recent Searches

Suggested Searches

Product Ratings

Resources

Chat With AskCR

Resources

All Products A-ZThe payment for your account couldn't be processed or you've canceled your account with us.

Re-activateMy account

Sign In

My account

Sign In

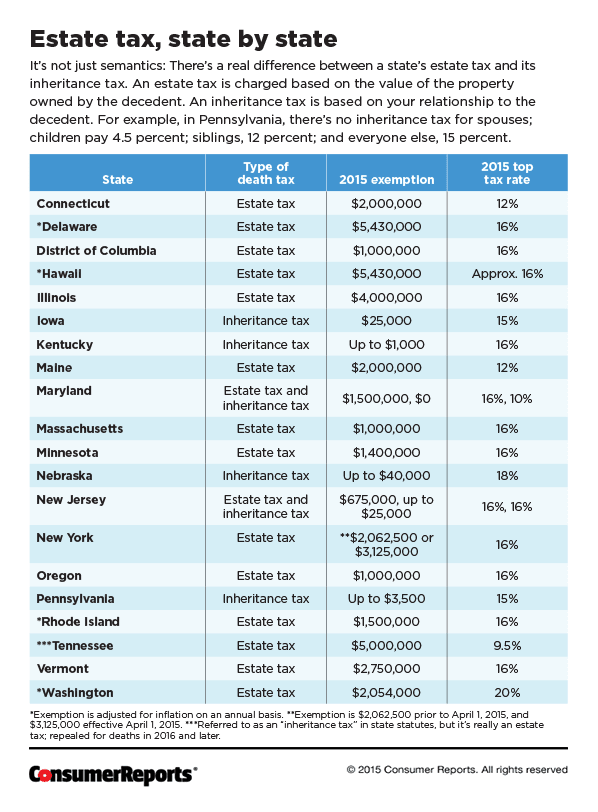

The chart below lists the estate and inheritance taxes levied by the states that impose them. Bear in mind that state laws on these matters change frequently, so check with an attorney or tax adviser if you inherit money in the future.

When you do your estate planning avoid these 6 minefields, and make sure you spare your heirs a battle over your estate.

––Mandy Walker (@MandyWalker on Twitter)

This article also appeared in the March, 2015 issue of Consumer Reports Money Adviser.

Build & Buy Car Buying Service

Build & Buy Car Buying Service

Save thousands off MSRP with upfront dealer pricing information and a transparent car buying experience.

Get Ratings on the go and compare

Get Ratings on the go and compare

while you shop