How to File a Car Insurance Claim

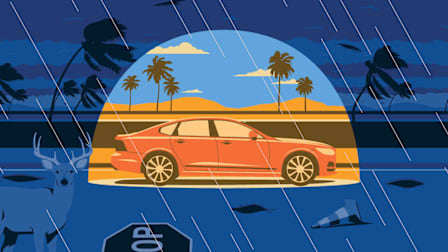

A step-by-step guide for what to do if your car is damaged by a crash, flood, fire, storm, or other disaster

Over the past few years, widespread flooding, wildfires, and violent storms have affected not only people’s homes but also their cars. Meanwhile, the number of crashes on U.S. roads has remained persistently high.

In 2024, auto insurers paid out over $260 billion in claims, according to the Insurance Information Institute (III). If you find yourself in a collision, or if your car has been affected by theft or a natural disaster, it helps to know the basics of filing a claim. The more quickly you act, the sooner you’re likely to receive compensation from your insurer.

For this guide, Consumer Reports consulted industry experts on how to best use your insurance policy.

How to File a Car Insurance Claim

If you’ve just been involved in a crash, you’re likely to be under a lot of stress. You may be staring at the smoldering or sodden remains of your car. Once you’ve checked anyone involved for injuries and moved to safety, it is time to call the police, then gather the key information and images you’ll need for a police report and to file a claim.

The claims process—and the part where you get paid—can take a while. Having a detailed account matters, and the sooner you collect and submit everything, the better.

Here’s what to do after an incident:

How to Set Up Your Liability, Collision, and Comprehensive Insurance

If you need an insurer, consult CR’s car insurance buying guide and car insurance ratings.

Your car insurance breaks down into three basic categories: liability, collision, and comprehensive.

Liability. It’s a good idea to make sure your insurance policy contains adequate liability coverage, which you’ll need in case you’re found at-fault in a crash. Liability insurance is required by law in most states (although some states allow car owners to pay an uninsured motorist fee in lieu of having insurance). This is the coverage that pays for another driver’s medical and repair bills if you’re found at-fault in a crash.

Collision. If you have a newer car, you probably have collision insurance, which pays for repair or replacement of your own vehicle if you’re at-fault. Although many people drop collision coverage on older cars, it can be worth keeping if you’re still paying off the car.

Comprehensive. Comprehensive coverage catches just about everything else—all the wild-card stuff like floods, fires, storm damage, theft, vandalism, and so on. For example, if a rotten tree branch falls on your car and crushes it, comprehensive insurance should cover that incident. Loretta Worters, vice president of media relations for III, says that only about 70 percent of policyholders have comprehensive coverage on their cars. “Unfortunately, if your car is damaged by something other than a collision and you lack comprehensive insurance coverage, you will likely need to pay for the repairs yourself,” she says. “Your insurance company won’t cover the damage.”

If you think your policy has you sufficiently covered, read on to learn more about what you can do ahead of time to be even more prepared.

Consider getting more liability insurance. The minimum liability coverage required by most states usually isn’t enough to cover your costs if you’re found to be at-fault in a major crash with injuries or death. For example, if a driver is covered only to New York’s minimum liability limits, and they cause a crash in which three people each receive $50,000 in medical bills, the driver would only be covered for $25,000 of each injured person’s bills—just half the expenses. That would leave the driver with a $75,000 out-of-pocket obligation that, if not paid, could be collected in a lawsuit.

CR recommends increasing your liability coverage to $100,000 per person, $300,000 per incident for bodily injury or death, and $100,000 for property damage. It might be worth adding something called an umbrella policy as well, although most insurers require you to have both your home and auto coverage with them in order to get one. An umbrella policy is a relatively inexpensive way to add $1 million or more of liability coverage. Remember, if you don’t have the cash to pay the out-of-pocket bills that your insurance doesn’t cover, the other party’s insurance company could come after assets like your house or 401(k).

Calculate your collision insurance. Most auto loan lenders will require you to carry collision coverage if you’re still paying off your car. That way, if the car is a total loss, you can repair damage or get all or most of the money to replace it. However, as your car ages and its value diminishes, it may be worth dropping this expensive add-on coverage. As a general guideline, if your annual premium is 10 percent of what the car is worth, consider canceling collision coverage. The amount of money the insurance company will give to repair damage caused to your car in an at-fault crash won’t justify the additional cost to your annual premium.

Keep your comprehensive insurance. Depending on where you live, comprehensive insurance typically doesn’t cost as much as collision insurance, but it covers a wide range of potential misfortunes. In addition to covering various “what if” and “act of nature” damage scenarios, many comprehensive policies include low- or no-deductible glass coverage that will pay for a windshield replacement if the glass is damaged by flying debris, stone chips, or anything else. If you don’t have comprehensive insurance, damage caused by a storm, wildfire, riot, or other natural disaster won’t be covered.

Know exactly what your policy covers. Be aware of any exclusions or limits in your policy, especially if you live somewhere like California or Florida where insurers have pulled out of the market after widespread damage from natural disasters. Also, find out whether your insurer will pay for a rental car if your damaged car needs extensive repairs. Many policies have limits on how many days of rental car coverage they include and how much they will contribute, so don’t assume you’ll be covered for as long as it takes to repair or replace your car. Also, keep in mind that wait times for car repairs are longer than now than they were in the past.

Bottom line: Preparation is the best protection. Start with a solid insurance policy from a top-rated provider, download the app, and keep all paperwork filed in a safe place. Be proactive about protecting your car through safe driving and smart parking practices.

More on Car Insurance

• CR’s Car Insurance Ratings and Buying Guide

• Best Car Insurance Companies

• How to Lower Your Car Insurance Rates

• Best Car Insurance Companies for Seniors

• Everything You Need to Know About Teen Car Insurance

• Proven Ways to Save on Car Insurance Even If You’re a Safe Driver

• How to Keep Your Car From Getting Stolen

• How to Prevent Catalytic Converter Theft