Worried Your Home Insurance Company Might Cancel Your Policy? Dealing With Skyrocketing Premiums? Here’s What to Do Next.

Even before the January 2025 California wildfires, more and more homeowners were having difficulty finding insurance and facing extremely high costs if they did. Here’s how to protect yourself.

Laura Morris’s house in Greenville, S.C., survived the punishing winds and rain of Hurricane Helene in September 2024. While her neighbors had trees fall on their houses or in their yards, her house suffered only minor damage.

But just a few weeks after the hurricane, the Morris family faced another potential disaster: a notice from their home insurer saying its policy would be canceled in 90 days. “I opened the letter 36 hours ago, and I’ve been reeling ever since,” she told CR in October 2024.

On the other side of the country, in Newport, Wash., something similar recently happened to Rich Archer and his family, even without a hurricane and even though they had never filed a homeowners insurance claim, they say. In 2023 their insurer refused to renew their policy, forcing them to find coverage elsewhere. While they eventually succeeded, they had to pay a hefty amount: $5,800 per year—more than twice what they previously paid.

Has Extreme Weather Increased the Cost of Your Home Insurance?

Share your story with us.

These cancellations are troubling. But sometimes a nonrenewal isn’t so forthright. A homeowner may be offered renewal at a price that’s so astronomically expensive and covers so little that they do what the insurer probably wanted them to do: walk away.

That’s what happened to a reader in St. Augustine, Fla., when it was time to renew his homeowners insurance. Despite having never filed a claim with the carrier, he was offered a new policy for $12,700, 400 percent more than he’d been paying. He finally found a policy from another company for $6,000, but it came with a $15,000 deductible for hurricane damage.

Imagine his dismay this past September when a huge oak tree fell on his house during Hurricane Helene. He says it cost $12,500 to have it removed and the roof repaired—$2,500 shy of his deductible. “It’s quickly becoming impossibly expensive to live in Florida,” he says.

“There’s no place to hide,” says Chuck Bell, senior policy analyst for CR. “Premiums have gone up much more sharply in some states due to extreme weather events like hurricanes and wildfires. Rates have risen by an average of 33 percent for consumers across the U.S. over the last five years, affecting many homeowners who live in regions not affected by natural disasters.”

We’ll explain why rates are rising—it’s not just because of the weather—and what you can do if your insurer refuses to renew your policy or hikes your premium so high that it’s unaffordable.

A Perfect Storm for Price Hikes

A number of factors contribute to rising insurance costs, creating a kind of perfect storm for consumers, Bell says.

Inflation, which has sharply driven up building costs, is one of them. According to the Bureau of Labor Statistics, between June 2019 and June 2024, labor for construction trade services rose 40 percent, and the cost of construction materials increased by about the same amount. “So even if you’re not in a disaster-prone region, or you’ve not experienced a natural disaster, there are still significantly higher costs to repair and replace property,” says Karen Collins, vice president of the American Property Casualty Insurance Association, an insurance industry group. Those higher costs are reflected in policy prices.

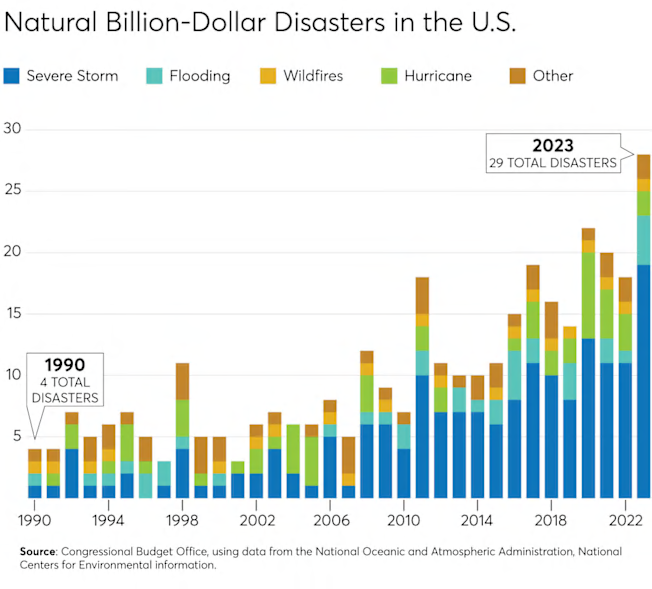

At the same time, more and more events are causing costly to repair property damage. Regulators, scientists, industry experts, and consumer advocates agree that climate change—warming oceans, longer droughts, higher inland temperatures, and excessive precipitation (rain, hail, and snow)—is causing natural disasters including wildfires, hurricanes, and floods to become more frequent and severe.

The numbers are staggering. Last year alone, the National Oceanic and Atmospheric Administration says there were 28 weather disasters causing at least $1 billion in insured losses, totaling $93 billion and resulting in almost 500 deaths.

Another factor is the explosion in the number of homes built in climate danger zones, Collins says. In wildfire-prone areas of Montana, for example, 22,000 homes were built between 1990 and 2018, according to figures by the research firm Headwaters Economics. Since then, an additional 31,000 new homes have been built in these risky zones, according to Wild Montana, a nonprofit that studies land use in the state.

It’s the confluence of high risks and high costs that have prompted some insurers, such as Allstate, Farmers, and State Farm, to stop writing new policies in California, along with Farmers and Progressive in Florida. Having fewer insurers means some markets have less competition and higher premiums.

Insurers Face Financial Turmoil

Adding to the problem is the fact that some insurance companies are finding themselves on shaky financial footing.

When disaster strikes a house, the money an insurance company uses to pay for a consumer’s claims comes from three main sources: premiums it has collected, returns from investments like stocks and bonds, and reinsurance, a type of insurance for insurers that helps cover them when other funds fall short.

But reinsurance, which provides insurance coverage for companies worldwide, has become significantly more expensive for insurers to purchase. Rates doubled between 2017 and 2023, according to a September 2024 Congressional Budget Office report (PDF). The same report said that “a catastrophe on the other side of the world can result in a decreasing amount of insurance capacity—and likely higher prices—in the United States.”

And as interest rates increased in the last several years, insurers’ financial performance in the bond market declined, according to a June 2024 Congressional Research Services Report.

Both increases in reinsurance costs and reduced bond performance matter, says Douglas Heller, director of insurance at the Consumer Federation of America, because it means insurers need more capital available in the event they need to pay claims when disaster strikes. To get it, “insurers raise premiums and reduce coverage,” he says.

“Essentially, growing climate risk is being downstreamed right onto the shoulders of individual American homeowners,” Heller says, “and that’s why people are seeing these nonrenewal notices or these spiking premium statements that make it really difficult to secure the most important asset they own.”

How to Fight a Nonrenewal or Find Alternative Insurance

If you have a mortgage, your lender requires you to carry some type of homeowners insurance, and you don’t want it to lapse for any reason, Heller says. If it does, the lender will step in and assign a type of policy (called “forced place”) that will cost you about twice as much as regular homeowners insurance but that essentially protects only the lender in case of a loss of your house, according to the Consumer Financial Protection Bureau.

If you don’t have a mortgage and live in an area where the policy options are few and very expensive for poor coverage, you might be tempted to go without insurance, as nearly 8 percent of homeowners in CR’s survey did. But that’s risky, too, Heller says. Instead, consider taking the following steps.

Confirm when the current policy expires and ask for a 30- or 60-day extension. Having more time will help you work through your options with your current insurer or shop around for new coverage without a pressing deadline.

Although an insurer isn’t required to give you more time, it might offer a courtesy extension if asked, says Robin Nunn, a consumer advocacy attorney and partner at Nelson Mullins firm in Washington, D.C. To do this, ask to speak to someone until you get as high up as needed, Nunn says. “And if you missed the mailed notice because of a specific reason, such as a death in the family, be sure to mention that as well,” she says.

Gather evidence. Ask for a written explanation for why the insurer sent a nonrenewal. For example, ask to see any aerial photos or video taken by drone or satellite that the insurer used to make its determination about a premium increase or cancellation, Nunn says. You’ll need these for the next step.

File an appeal right away. That worked for William Wilkin in Nashville, Tenn., when his insurer said it wouldn’t renew his policy unless he repaired his roof. Wilkin’s insurance agent got hold of the satellite images the insurer used when issuing a nonrenewal and was able to demonstrate that shadows from the trees made the roof (which was quite new) appear to be in disrepair.

When combined with a roofer’s written inspection report and high-quality, close-up photographs of the roof submitted to the insurer with a letter, Wilkin was able to retain his insurance.

Act fast when asked to make repairs. When possible, make repairs without delay, Nunn says. That helped Joan Bobier in West Windsor, N.Y., retain her coverage after receiving a nonrenewal letter just two weeks before her existing policy was to expire. “They said they were going to cancel my insurance because I had moss on the roof,” Bobier says. She was able to get help on short notice and was quickly able to send pictures of a clean roof along with receipts.

Don’t wait for your appeal to be determined before you shop for a new policy. “You’ll want to start shopping for new insurance at the same time you’re working on the appeal, because you may just have 30 days or less to find new coverage,” Nunn says.

Find a local, independent insurance agent or broker. Doing so can be more efficient than looking online yourself, and they will be able to include smaller insurers that may operate only in your area or state. Not sure whether an agent is truly independent? Ask whether they act as a broker with multiple insurers or with just one or two companies.

Can’t find a private plan? Look for a state-sponsored one. California, Florida, Hawaii, and New York, along with 29 other states and Washington, D.C., offer state-mandated plans for high-risk homeowners that are called Fair Access to Insurance (FAIR) plans. To see whether your state offers one, call its insurance office. (The Insurance Information Institute lists contact details for all 50 states.) If you live in Florida or Louisiana, consider plans offered in those states called Citizen plans, which aren’t as bare-bones as FAIR plans, Heller says. As state-mandated plans, these are more expensive and generally offer less coverage, Bell says, and because of that, they’re usually a last resort.

These plans have such limited coverage and are really intended to provide catastrophic coverage, according to the National Association of Insurance Commissioners. So you may want to consider a second, more comprehensive policy to cover everything else, Heller says. These add-on policies are known as “wraparound” coverage and can be purchased on the private market. Enlist the help of your broker to find one that works for you, Heller says.

As a last resort, shop for an E&S (excess and surplus) policy. If there are no FAIR plans in your state, or their coverage is too limited or too expensive, you could consider this kind of policy. These are not backed, reviewed, or regulated by the state you live in—and they can have all kinds of exclusions, restrictions, and limitations that you won’t find in a traditional home insurance policy, Heller says. He cautions homeowners to tread very carefully if considering coverage from these kinds of insurers.

But E&S policies might cover more types of risks, provide more protection, and offer higher deductible options than what’s allowed with traditional homeowner insurance plans approved by your state.

If you go this route, stick with larger carriers, such as AIG or Lloyd’s of London, because they’re less likely to go bankrupt in the event of a disaster, Heller says. If a company does go belly-up, you’ll have little legal recourse when trying to file a claim.