Sign In

Americans have lost confidence in the U.S. health-care system and yearn for reforms that will free them from worry about losing coverage if their circumstances change or if they fall ill.

Our new national survey plumbs people's opinions about those elements they consider essential in a reformed system.

Among the 1,200 Americans age 18 and older who responded to the November 2007 telephone poll, more than 80 percent said that a reformed system should guarantee the following:

Poll respondents agreed broadly that reform should improve access and coverage, but there's less consensus on how to achieve it.

Right now, pessimism about U.S. health-care costs prevails among consumers regardless of age, gender, political orientation, or family income.

Fifty-three percent said they are paying more for health care than they were a year ago, while only 5 percent report declining costs. Seventy-seven percent expect costs to be higher still in five years.

Overall, 81 percent say they are concerned about being able to afford health care in retirement, 68 percent worry about being bankrupted by medical bills following a serious illness or accident, and 65 percent fear losing their job-related health coverage.

Pressured by rising costs, 35 percent of respondents say they skipped or postponed medical care to control expenses over the previous 12 months.

Respondents laid the blame for America's health-care problems mainly on drug and insurance companies. For more details on those findings, see High health care costs.

Consumer Reports also invited subscribers to share their health-insurance stories online, and hundreds responded.

"We worry about the future," said Jeff Averill, a 40-year-old self-employed construction inspector from Billings, Mont., in a phone interview. He's had to raise his health-insurance deductible for his family of four to $14,000 just to keep premiums affordable. "The current system is broken," he said. "It's just not working."

When our questions turned to how, exactly, a reformed health system would work, respondents were considerably more divided than they were about what such a system should achieve.

We asked for their opinions on four approaches to health-care reform, including those proposed by leading presidential candidates.

The most popular proposal drew support from half of the respondents. That was for a mixed public/private system that would require all uninsured Americans to buy health insurance. The cost of the insurance, deductibles, and co-pays would be adjusted based on income, with subsidies for lower-income Americans. Massachusetts is in the midst of implementing that type of system, and versions of it have been proposed by the leading Democratic presidential candidates.

Thirty-six percent of our poll respondents support public insurance, which would move all Americans, including those now covered through private insurance, to a Medicare-like plan funded by federal taxes. That is an approach similar to the Canadian health-care system.

One-third of respondents we surveyed favored a mix of employer-sponsored plans, private health-insurance plans, Medicare, Medicaid, and other public programs, which is the arrangement we have today. (People were allowed to choose more than one reform proposal, so percentages add up to more than 100.)

Only 26 percent supported the idea of giving tax incentives for individuals to purchase insurance and relying on market pressures and competition among insurance companies to hold prices down. Versions of that idea have been proposed by several leading Republican candidates.

Interestingly, even respondents who identified themselves as conservatives picked a mixed public/private system as their top choice, and one-third favored an all-public plan.

Experts on health-care reform who we consulted said they were not surprised by the disconnect our survey found between the system Americans say they want and the road map for getting there.

"Surveys consistently show that Americans want reforms," said Gerard F. Anderson, professor of health policy and management at Johns Hopkins University. "However, they do not want major changes in how they get health care, and they do not want to pay much to reform the health-care system or to expand coverage."

The Achilles' heel of reform is that most Americans do have some source of insurance most of the time, says Jacob S. Hacker, a political science professor at Yale University who has studied health-care reform. "The easiest way to kill reform is to say that this change will destroy what you have and will make you pay more for less," he says. Reformers need to put forth a "clear, simple, and unthreatening vision of reform that meets public concerns head-on."

Health-care reform will be a central issue in this year's presidential election. Consumers Union, the nonprofit publisher of Consumer Reports, will be pressing for changes that ensure that all Americans can get high-quality health care at a price they can afford, including guaranteed access and improved delivery of health care.

As it is, millions of families are one serious illness away from bankruptcy. Unchecked growth in the national health bill could create untenable economic instability for the nation within a decade. And it's estimated that patients receive medically appropriate care only about half of the time.

As state and federal proposals come up for serious debate, here are some criteria by which Consumers Union will judge them:

Complete coverage. Private insurance and public programs, such as Medicare, Medicaid, and the State Children's Health Insurance Program, must be expanded to guarantee that everyone is covered from cradle to grave, regardless of health status or ability to pay. Coverage should include all necessary medical services and leave no one in fear of delayed or denied treatment.

Fair cost spreading. No family should face financial ruin to pay for health care. Costs should be spread fairly among government, employers, and consumers.

Safer care. Millions of Americans are harmed each year by the care they receive. Improved safety systems would save billions of health-system dollars.

Better care. All too often, health-care decisions are based on financial incentives, not science. Comprehensive, easy-to-understand public information about the safety, cost, and quality of care by doctors, hospitals, and nursing homes would help consumers and employers choose the best care. Electronic medical records should be deployed, with strict privacy protections, to gather treatment results and to help consumers manage their care.

Prevention. Smoking- and obesity-related illnesses such as certain cancers, heart disease, and diabetes threaten to overwhelm health expenditures. The primary-care physicians whose job it is to prevent and control those conditions are the most poorly paid of all doctors. Reforms should give patients and doctors more support for banishing bad habits before they lead to costly illnesses.

Eighty percent of people we surveyed said the pharmaceutical price gap between the U.S. and the rest of the world is unacceptable. Here's the average retail price for a month's supply of popular brand-name drugs in the U.S. and in six other countries.

| COUNTRIES | Actos (diabetes) |

Lipitor (cholesterol) |

Fosamax (osteoporosis) |

Nexium (heartburn) |

Singulair (asthma) |

|---|---|---|---|---|---|

U.S. |

$86.13 |

$68.37 |

$64.16 |

$92.04 |

$83.40 |

Australia |

41.10 |

24.27 |

32.98 |

22.23 |

57.21 |

Canada |

62.22 |

48.45 |

35.07 |

60.69 |

63.21 |

France |

31.38 |

19.53 |

34.11 |

30.63 |

43.02 |

Germany |

38.52 |

29.73 |

37.35 |

19.26 |

58.08 |

Japan |

21.48 |

30.57 |

23.61* |

NA |

59.97 |

United Kingdom |

45.72 |

34.17 |

40.31 |

35.04 |

51.09 |

A majority of people at all family income levels, even the most prosperous, are worried about being able to afford health care when they need it. Below are the percentages of respondents moderately or severely concerned about:

| Income | |||

|---|---|---|---|

| Less than $50,000 |

$50,000- $100,000 |

More than $100,000 |

|

Being unable to afford health care in retirement |

88% |

76% |

74% |

Being bankrupted by medical costs due to an illness or accident |

81 |

60 |

50 |

Losing health-care coverage due to being laid off or leaving your job |

74 |

60 |

58 |

Being unable to pay for health care for aging parents |

66 |

57 |

53 |

Source: Consumer Reports National Research Center telephone poll of a national sample of 1,200 adults,

November 2007.

Drug companies, insurers, politicians, lawyers, and the bad habits of Americans all figure into high and rising health-care costs. But the biggest contributors to high costs—doctors and hospitals—get off easier among consumers, our survey found.

"The aim of our health-care system should not be to make a profit for insurance and drug companies. It should be to provide affordable, high-quality care for all Americans," said Andrea Hanson, 31, a college teacher from Murphy, Texas, who responded to our invitation to share her story online.

The focus on drug and pharmaceutical companies is not surprising because of the way that most Americans pay for health care, said experts we consulted.

"Americans tend to focus on the bills they pay, not the total cost of health care," said Jacob S. Hacker, professor of political science at Yale University. "And the bills for most Americans ultimately reflect what insurance companies don't cover and what drug companies charge consumers at the pharmacy. They see the big profits these companies earn even as they, the patients, are struggling to pay their bills."

But a closer look at health-cost trends shows that these players, in roughly descending order, contributed the most to rising costs:

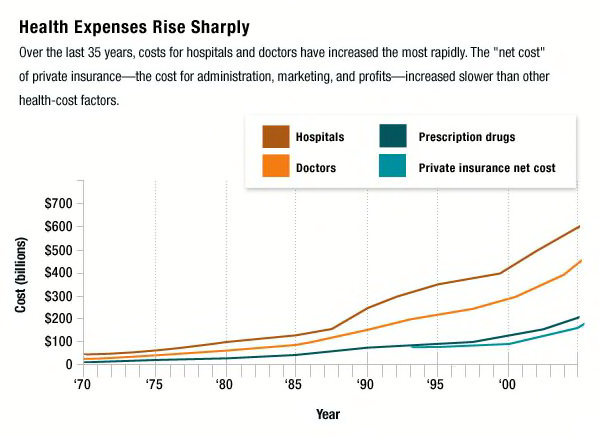

Hospitals and doctors. Doctors and hospitals account for by far the largest share, 52 percent in 2006, of all national health spending. There's abundant evidence that some of that spending is unnecessary. Under the present system, hospitals and doctors earn more money by doing costly interventions than by keeping people healthy. And more medical care doesn't necessarily mean better care, according to research on Medicare expenditures by the Dartmouth Medical School's Institute for Health Policy and Clinical Practice.

Yet just 59 percent of our survey respondents named hospitals, and 47 percent named doctors, as major spending culprits. (Percentages add up to more than 100 because respondents could select as many factors as they wanted.)

Drug companies. Prescription drugs account for only one-tenth of total health-care expenditures. But drug spending has increased as a share of overall expenditures over the past decade.

Seventy-six percent of respondents blamed drugmakers generally, and 74 percent said drugmakers charged too much for their products.

Insurance companies. Health-insurance premiums have grown faster than inflation or workers' earnings over the past decade, in parallel with the equally rapid rise in overall health costs. Industry spending on administrative and marketing costs, plus profits, consumes 12 percent of private-insurance premiums.

Seventy-seven percent of respondents blamed insurance companies in general for high costs, and 70 percent said insurers overcharged for their products and services.

Politicians and government regulators. Although the government directly controls only 46 percent of national health spending, many of its policies affect the bottom line of the health-care industry, for example, by setting Medicare reimbursement rates for doctors on which private insurers base their rates, or by regulating health insurance. Between 1999 and 2006, the health-care lobby spent more than any other business sector, according to a study by the Institute for Health & Socio-Economic Policy, a nonprofit policy and research group.

Sixty-four percent of respondents faulted politicians and 58 percent faulted government regulators for failing to control health-care costs.

Lawyers. Malpractice-insurance premiums and liability awards account for less than 2 percent of overall health-care spending, according to a 2004 study by the Congressional Budget Office. Defensive medicine, the practice of ordering extra tests or procedures to protect against lawsuits, might add another few percentage points, according to some estimates.

Yet 60 percent of respondents blamed lawyers for high costs, and 69 percent specifically pointed to "frivolous lawsuits."

Health-care consumers. "Modifiable" risk factors, such as eating too much, exercising too little, or smoking, are to blame for an estimated 25 percent of U.S. health-care costs, according to expert estimates. But even if every American took up healthful living overnight, our health-care expenses would still be the second highest in the world (after Luxembourg).

Sixty-eight percent of respondents thought those bad habits were to blame for high U.S. health costs.

A mere 41 percent of respondents blamed consumers for overusing services.

And the respondents "are correct not to believe that," said Hacker. "Patients have little control over the amount that hospitals and doctors charge. Our exorbitant medical prices are a result of the fragmented structure of our health-care system, not the choices of patients."

WASHING MACHINE REVIEWS

WASHING MACHINE REVIEWS GENERATOR REVIEWS

GENERATOR REVIEWS

Build & Buy Car Buying Service

Build & Buy Car Buying Service

Save thousands off MSRP with upfront dealer pricing information and a transparent car buying experience.

Get Ratings on the go and compare

Get Ratings on the go and compare

while you shop