Sign In

One little-known feature of the Affordable Care Act is the availability of special health plans with low deductibles and copays to consumers whose incomes are low, but not low enough to be enrolled in Medicaid. (For 2015 that's up to $29,175 for a single person, $39,325 for a couple, and $59,624 for a family of four. Details here.)

Unfortunately, many people eligible to buy these plans may never realize it because of the way HealthCare.gov, the site that sells health insurance to individuals in 38 states, displays plan results. Instead, they may end up with plans that, although their premiums are slightly lower, have extremely high deductibles that could put health care out of reach financially.

The plans they're missing are special versions of the mid-priced Silver plans, the most popular of the four "metal tiers"—Bronze, Silver, Gold, and Platinum—sold on the state Health Insurance Marketplaces.

Whereas regular Silver plans cover about 70 percent of the average person's health care costs, the special Silver plans cover 73, 87, or 94 percent, depending on the person's income. That translates into much lower deductibles, copays and coinsurance. The Silver 87 plan is more generous than a regular Gold plan, and the Silver 94 plan is more generous than a Platinum plan. But the customer doesn't pay a higher premium for these plans than for the standard version of the plan. In other words, they're a fantastic deal.

Here's the problem. When people in the eligible income range window-shop on HealthCare.gov, the only clue they have that the special plans are available is the fine print on the initial eligibility page. It says, "This household may also be eligible for a cost-sharing reduction on a Silver plan that reduces the out-of-pocket expenses paid for deductibles, copayments, and coinsurance."

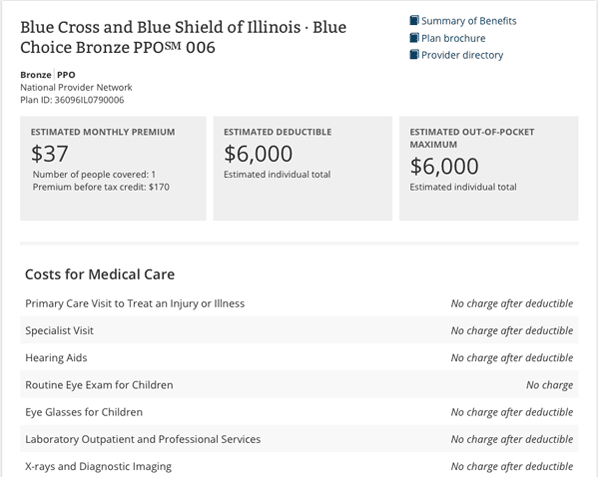

But when the shoppers then click on the button that says "Continue to plans," the plans with the lowest premiums are displayed first. These are the Bronze plans. But even though the Bronze plans may have somewhat lower premiums, they don't have the cost-sharing reductions and can have extremely high deductibles.

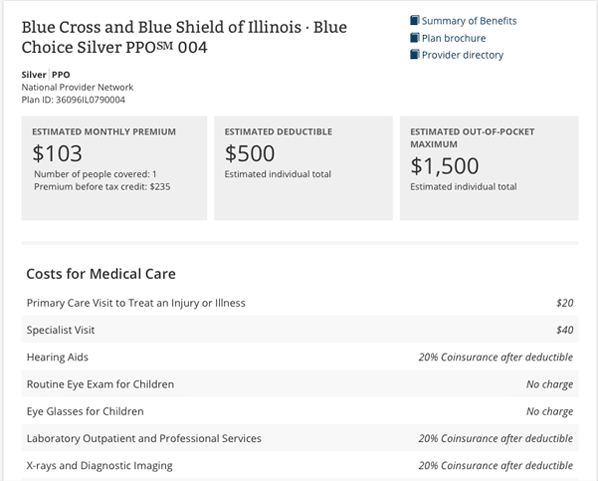

Below you'll see the first result from a search we did in Illinois for a single 40-year-old with an income of $20,000, which would qualify them to buy a Silver 87 plan.

It's a Bronze Blue Cross and Blue Shield PPO. Granted, it only costs $37 a month after subtracting the $133 premium tax credit. But look at the plan details: The customer will have to spend $6,000 of his meager income before the plan covers a single service other than preventive care, which is free in all plans.

The second example from our search is a special Silver 87 PPO from the same company, shown at the top of the page. Yes, the premium is higher: $103 instead of $37 after the credit. But the deductible is only $500, and the plan covers doctor visits for a low copay even before the deductible is met. It's not captured in the screen shot, but the plan also covers generic drugs at no cost and brand name drugs with a $50 copay before the deductible is met, whereas the Bronze plan won't pay for prescriptions of any kind until that $6,000 deductible is satisfied.

Finally, the Silver plan has an annual out-of-pocket limit of $1,500, which means that once the consumer has spent that much out of his or her own pocket for health care, the plan will pick up 100 percent of health care costs for the rest of the year. The Bronze plan's out-of-pocket limit is the same as its deductible, $6,000.

We think it's possible, even likely, that the average lower-income customer might never see this plan because it would require (a) knowing that the special Silver plans really are a good deal and (b) clicking through to the fifth screen of results (we counted!) to find it and (c) being able to figure that it's one of the special plans despite the fact that there's nothing to indicate it on the listing.

Consumer Reports recently asked a HealthCare.gov official why the site doesn't display these special Silver plans front and center for eligible consumers. He didn't answer directly, but did say that call center employees and in-person navigators and assisters are well aware of the plans and have "done a good job communicating highest value options for consumers."

We were curious to see whether any of the state-run Marketplace websites are doing a better job of steering eligible people to the special plans, so we ran a search for our same $20,000-a-year 40-year-old on the sites that offer window shopping.

Sure enough, we found four that were doing an outstanding job. California, Maryland, Rhode Island, and Washington showed the Silver 87 plans first, along with an explanation of why they were such a good deal. Vermont did a good job of highlighting the availability of the plans but displayed them as a large, unwieldy .pdf.

Others could improve. Connecticut clearly highlighted the availability of the plans but still showed the lower-premium Bronze plans first. Idaho highlighted the availability of the plans, showed the Bronze plans first—but also offered a filter to isolate silver plans with "special discounts," a term that might not mean much to consumers.

Hawaii flagged the availability of plans with "cost sharing reductions," but its plan display not only didn't list those plans first, it was also the only site where we couldn't see anything about the plan's deductibles without clicking on each plan individually.

We couldn't evaluate the other state-run Marketplaces (Massachusetts, Minnesota, New York, and Washington, D.C.) because, unfortunately, they don't offer window shopping at all.

If you are in the income range that's eligible for the special Silver plans with lower out-of-pocket costs, make sure you have seen and evaluated them before making your plan selection. If you aren't sure you have found them, ask for help through the customer service number or make an appointment with a local in-person helper.

Submit a question to Consumer Reports' health insurance expert. Be sure to include the state you live in so we can provide a more-detailed answer.

Not sure where to begin with getting health insurance? Our free interactive tool, Health Law Helper, will point you in the right direction.

To find out how to apply for, select, and use health insurance, including Medicare, visit our main health insurance page.

Build & Buy Car Buying Service

Build & Buy Car Buying Service

Save thousands off MSRP with upfront dealer pricing information and a transparent car buying experience.

Get Ratings on the go and compare

Get Ratings on the go and compare

while you shop