Credit Karma Told to Halt ‘Pre-Approved’ Credit Card Offers

The free site settles an FTC suit for $3 million but disputes claims that the offers were deceptive

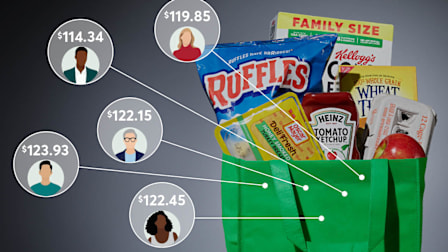

Credit Karma, a free personal-credit monitoring site, made deceptive “pre-approved” credit card offers to clients who ended up getting rejected and saw their credit score drop, according to a lawsuit filed by the Federal Trade Commission (FTC).

Credit Karma, which settled the suit but disputes the FTC’s allegations, agreed to pay $3 million to people who allegedly wasted time applying for credit that they weren’t actually pre-approved for.

The FTC alleges that from February 2018 to April 2021, the company told consumers they had “90% odds” to be approved to entice them to apply for credit card offers.

9 Ways to Raise Your Credit Score

Taking these actions can help to raise a sagging score. Just don’t expect it to happen overnight: Depending on the reasons for a poor score, it could take from 12 to 24 months to see a difference.

1. Regularly monitor your credit reports. Mistakes on your credit reports can be costly—and common. A study by the Federal Trade Commission found that 1 in 5 consumers had an error on his or her credit report that was corrected after it was disputed. Consumers are entitled to receive three free credit reports each year—one from each of the three major credit reporting agencies: Equifax, Experian, and TransUnion. A smart way to monitor your credit is to go to annualcreditreport.com and request a free report from a different agency every four months. Common errors to look for include: credit accounts that aren’t reflected, duplicate credit accounts, debts incurred by a former spouse, and bad debts older than seven years. You can initiate a dispute online at each of the three major credit reporting agencies.

2. Pay your bills on time. Approximately 35 percent of the FICO score is determined by your payment history, and 96 percent of those with the highest FICO scores have no missed payments. It’s better to pay the minimum on credit cards each month than to fall behind.

3. Don’t apply for several credit cards at once. This generates numerous inquiries into your credit history, which may lower your score. Another reason: Opening several new credit accounts at the same time reduces the average “age” of your accounts, which can also lower your credit score. However, multiple requests within a 45-day period for a single type of credit (mortgage, auto loan, or student loan, for instance) are counted as a single inquiry to allow consumers to shop around for the best rate. These are less likely to lower your score.

4. Don’t cancel unused cards (unless they carry an annual fee). Roughly a third of your score is based on the ratio of credit used to total available credit. Eliminating a card will lower your available credit and can work against you.

5. Keep credit balances low. Because a high credit ratio can negatively affect your score, maintaining a low revolving credit balance is wise. (Most people with the highest FICO scores owe less than $3,000 on revolving accounts.)

6. If you charge everything on a rewards card for the points, switch to cash or a debit card for a couple of months before applying for new credit. Even if you pay your balances in full every month, a lot of debt relative to your credit limit can still be viewed negatively.

7. Maintain a variety of credit types. Successfully paying, say, an auto loan, a student loan, and credit card bills over the same period shows that you’re able to juggle different types of credit. That diversification accounts for 10 percent of your score.

8. Pay off debt in collection. With the most current version of the FICO score, debt that was referred to a collection agency but has been paid off will no longer count against you. (Always dispute any debt that has been wrongly assigned to you.)

9. Get a secured credit card after bankruptcy. If you’ve been through bankruptcy, using a secured credit card backed by a refundable deposit may be an effective way to start rebuilding your credit. A bankruptcy will have less impact on your score over time if you don’t default on new loans. It may be a while before you can access credit inexpensively again: Chapter 7 and Chapter 13 bankruptcies stay on your credit report for up to 10 years.