Sign In

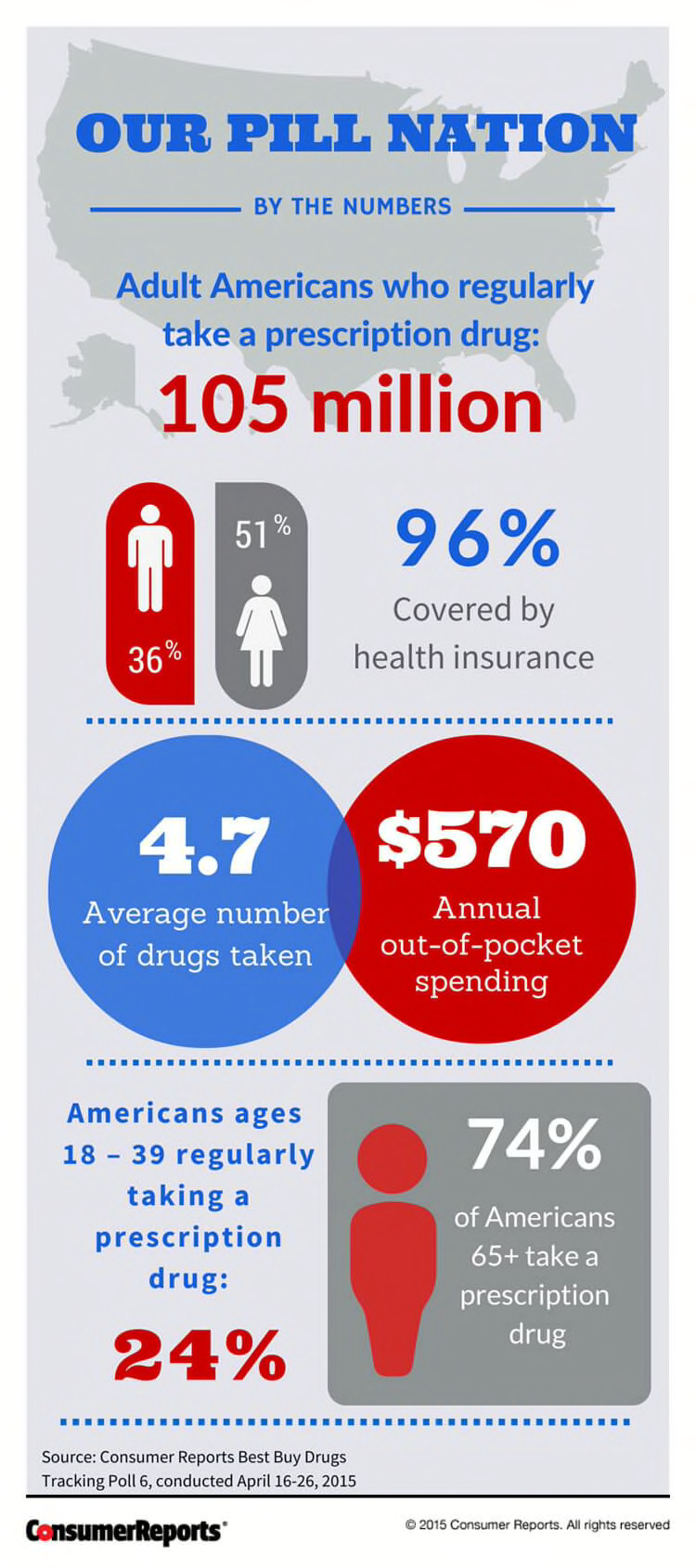

Not all surprises are good, especially when that surprise means you pay more for a prescription drug you take all the time. Yet in the last 12 months, that's exactly what happened to one third of Americans in our survey. People said they paid an average of $39 above the usual cost for their prescription—and one in 10 said they paid a whopping $100 or more out-of-pocket. That's according to a new Consumer Reports poll of 1,037 U.S. adults who currently take a prescription medication.

Denise Nolan, 49, of Lincoln, Nebraska, found out first-hand how pricey some drugs have suddenly become when she went to fill her prescription this past July for a common and usually inexpensive medication to treat rheumatoid arthritis. She was shocked when she was told by her pharmacist at a large, chain drugstore that the price for generic hydroxychloroquine had suddenly doubled to more than $500 for a three-month's supply. "I about fainted because we don't have insurance," says Nolan.

Want to learn how to save money on your meds? Check out the new and improved Best Drugs for Less magazine, available in both English and Spanish!

Unfortunately, Nolan's situation is increasingly common. Rising drug prices, especially for generic medications, have become such a problem that two members of Congress, Rep. Elijah Cummings (D-Maryland) and Sen. Bernie Sanders (I-Vermont), asked the Office of the Inspector General earlier this year to investigate—especially since the federal government pays for more than one-third of all prescription drugs in the U.S.

One recent analysis by the research firm Pembroke Consulting found that from August 2013 to August 2014, half of all generic drugs had increased in price, while one-tenth had gone up by 100 percent or more. The most outrageous price hike researchers found? During that time, the wholesale price of the antibiotic tetracycline, in the 500-mg dose, skyrocketed by 17,711 percent, from $.05 to $8.59 per pill. Analysis done by the firm since then still shows some generics have increased in price (37 percent), but by much smaller amounts; while two-thirds of drugs dropped in price.

Drugs to treat asthma, high blood pressure, and irregular heart rhythm medications top the list of drugs that have seen prices increases in the last several years.

In Denise's case, her pharmacist said the price hike for her drug stemmed from a shortage in the market. That can happen when fewer manufacturers make a drug, if demand for the product increases, or there's a reduced supply of an active ingredient. Or, more commonly, generic manufacturers may have production problems that result in reduced quantities of a product, or delays in getting the drug to market. That's according to an analysis by the American Society of Health-Systems Pharmacists (ASHP) prepared for Consumer Reports.

Talk to us about it below.

Shortages or even reductions in supply can trigger sudden price changes, which can then affect how insurance companies categorize a drug on their formulary, a list of drugs that insurance covers. You'll get the lowest out-of-pocket costs or co-pay when you buy the coverage plan's "preferred" generic drugs, typically called "Tier 1." Another category sometimes seen is called "acceptable" generic drugs" are slightly more expensive, followed by preferred brand-name drugs, then acceptable brand-name drugs. The highest tier, typically called "Tier 4," is for very expensive drugs such as those to treat cancer or hepatitis C. A drug that isn't listed on the formulary will have the highest out-of-pocket cost; you may pay a pre-negotiated, higher rate, or it simply won't be covered at all.

Insurers may opt to reduce coverage of a drug—moving it from a Tier 1 into a more expensive tier, for example—or stop covering it all together. Other common scenarios can also result in price hikes. For example, people on Medicare Part D face the "donut hole"—the situation where, after you and the plan pay $2,960 together, you have to pay for medications out of pocket until the total reaches $3,310. In other cases, a growing number of people have high-deductible insurance plans from their employers, which can require paying a higher amount for medications out of pocket before their insurance kicks-in.

"This never used to be an issue," says Chris Roberts, operations manager for Liberty Pharmacy, an independent drugstore that opened in Austin, Texas seven years ago. He's in charge of ordering medications to stock the pharmacy. "Price increases started about a year and a half or so ago, says Roberts. "For whatever reason, raw material shortage or some other problem, literally overnight we'll see a dramatic increase." He says that their pharmacy tries to help patients by getting medications switched to lower-cost drugs, working with their insurance company to get a drug covered, or even looking for manufacturer coupons when it's a branded drug.

The problem is that surprise price hikes usually leave people with two options: Either pay the high price or leave without filling the prescription. That was the case for Denise, who simply paid the more expensive price for her medication out of her pocket. "We're sort of at their mercy," says Nolan.

In our poll, most people (81 percent) said they, too, paid for the drug despite their sticker shock. But some still scrambled to get a lower price. One-quarter of people said they called their insurance company to see if it would cover a greater percentage of the cost, or asked their doctor or pharmacist to switch their prescription to a lower-cost medication (some did both). Just 17 percent of people said they tried shopping around at other pharmacies for a lower price.

Most alarming, some said that higher drug prices affected their ability to pay for other medical care. People who faced unexpected high costs were more than twice as likely to avoid seeing their doctor or forego a medical procedure than those who didn't.

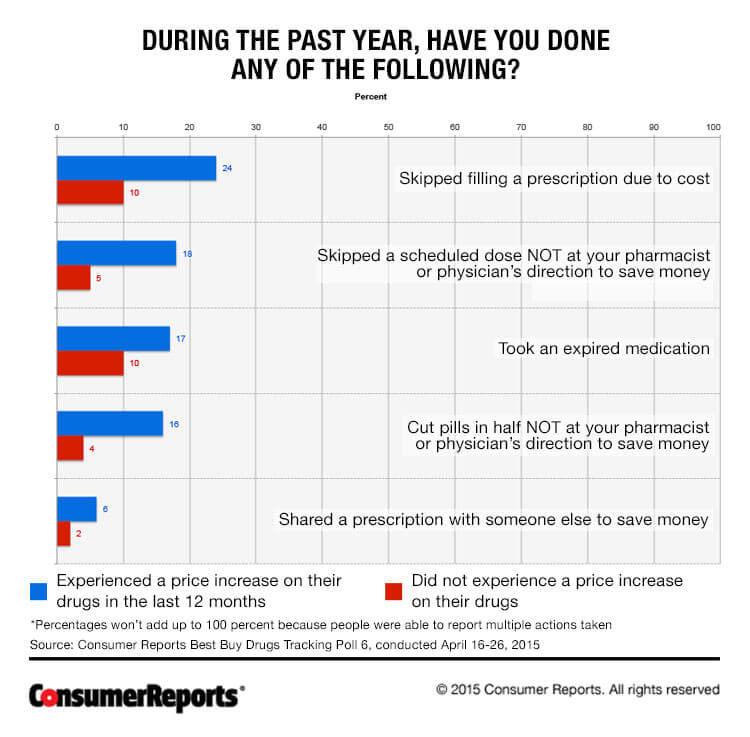

And that's not all. Nearly 40 percent of people in this situation cut at least one corner with their medication in order to save money.

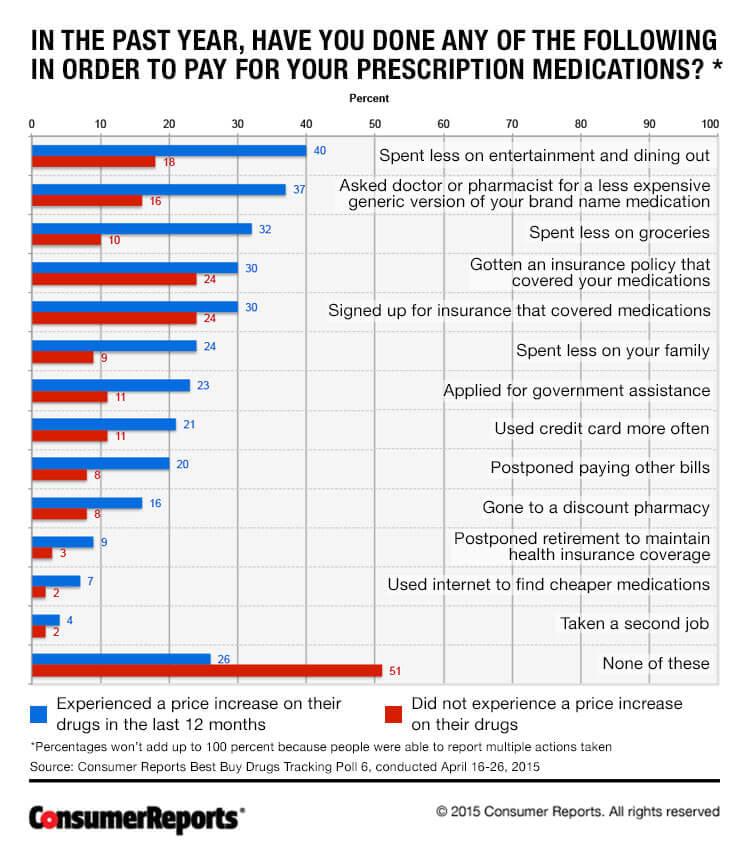

Higher drug costs exacted another toll on American's finances: The need to cut costs in other areas of personal spending to make ends meet. Nearly three-quarters of people with higher drug costs said they economized in other ways during the last year in order to afford their medications, even affecting how much money they spent at the grocery store and whether they chose to retire last year.

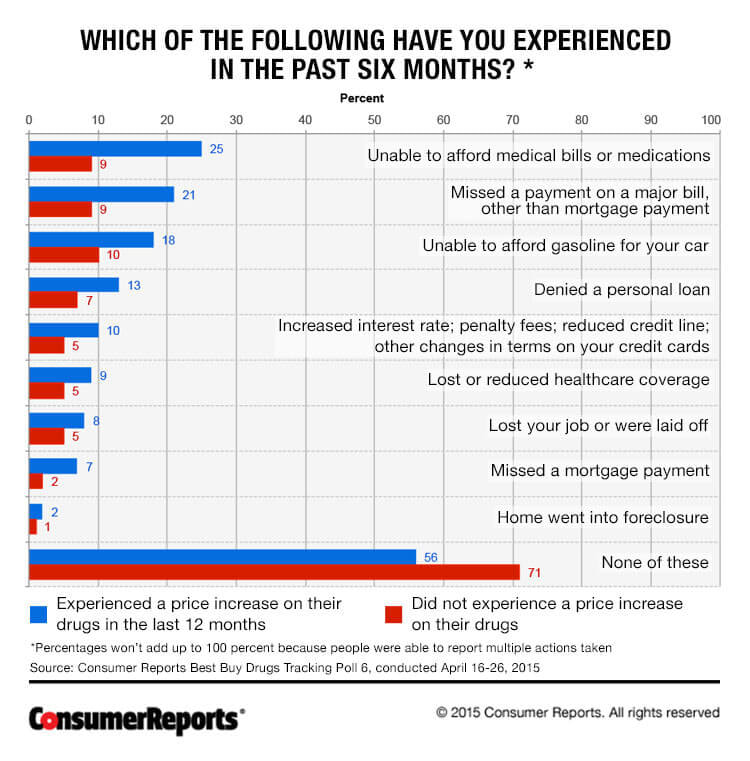

In the last six months alone, 42 percent of people who experienced a surprise drug price increase also suffered at least one economic setback. The number one problem? One of out every four people facing higher drug costs were also unable to afford medical bills or medications; one in five said they missed a payment on a major bill. (That could mean credit card bills, car payments—anything other than a mortgage payment.)

In spite of the difficulties some consumers face paying for their medications, many people rarely discuss the problem with their doctors. That's partly because most people don't even know how much a drug costs until they fill the prescription. In our survey, nearly two-thirds (63 percent) of people said they first learned about a drug's cost when picking it up from the pharmacy, while only 5 percent found out at the doctor's office. That's not surprising: Doctors say they're often unaware when drugs have large price increases.

So, when your doctor writes a new prescription, ask him or her how much it will cost you; if they can't tell you that, ask if they can find out if the drug is covered by your insurance. And insist that they at least take steps to keep your costs low by prescribing low-cost generics when they are available. One problem we found is that although generics can still provide major savings, four out of 10 people said their doctor "sometimes" or "never" recommends generics over brand-name drugs.

Consumers weren't shy when it came to discussing drug safety – 70 percent reported speaking to their doctor or nurse about side effects when starting a new drug.

Chasing down affordable drug prices is not always easy, but it can pay off. Try these steps.

• Ask your doctor or pharmacist to review all of the drugs you take and determine if you can stop taking any of them. Our poll found that 44 percent of adult Americans say they regularly take at least one prescription drug; but the average was almost five medications. Your doctor or pharmacist may be able to determine if some medications are duplications or no longer needed. Not only could this save money, but reducing the total number of medications you take also lowers the chances of experiencing an accidental drug error or side effect.

• Make sure your prescribed drug is covered by your insurance. If it's not, ask your doctor to prescribe a different drug that is on your formulary. If that's not possible or your doctor says it's not a good idea, ask him or her to petition your insurance company to cover the drug. If your health plan denies your request, you can file an appeal.

• Consider other medications if the price is too high. Ask the pharmacist or call your doctor to find out if there is a more affordable drug in the same class of medications or if there's an acceptable alternative. Ask for a generic version if you've been taking a brand-name drug.

• Use your insurer's preferred pharmacy: Some commercial plans, as well as Medicare Part D and Advantage plans, have preferred, retail pharmacies. Check with your plan to make sure you are using one of those in order to get the best price.

• Consider your insurance company's mail order service. For certain medications, using mail order may help you save money.

• Try getting your prescription from Costco. If you suddenly find that you'll need to pay for your prescription entirely out of pocket, put Costco on your list of places to price check. Our secret shoppers have found that Costco usually offers the lowest retail prices on medications. For example, a month's supply of the generic antidepressant duloxetine (Cymbalta) cost $220 both at a Kmart and at a Walgreens in Raleigh, N.C., but just $55 at a nearby Costco. Bonus: You don't need to be a member, either.

• Shop around. Call other drugstores in your area too. Independent pharmacies may also offer extremely low prices, though some charge high prices as well. For example, in the Des Moines, Iowa area, our secret shoppers found the generic drug pioglitazone (Actos) for wildly different prices at two independent pharmacies: One store charged $328 for a month's supply; another charged $20. And, if you live in a metropolitan area, consider checking with pharmacies outside the city because prices can sometimes be less expensive in pharmacies that are located in suburban and rural areas.

• Ask the pharmacist, "is this the lowest possible price you can offer?" That's especially true for when you are paying for a drug entirely out of pocket. But, it could still worth asking even if you use your insurance. Our secret shoppers found that by asking for the lowest possible price, they could occasionally get additional discounts. Case in point: A Target pharmacy in Des Moines, Iowa, first quoted a price of $191 for duloxetine. Our analysis suggested that the price was too high, so we called again and asked for the lowest price the store could offer. Our new deal: $160. (See tip above, because after that, we kept calling around in the area and were quoted a price of $7.50 for the same drug at an independent pharmacy just 7 miles away.)

• Try to negotiate. Independent, mom-and-pop pharmacies say they will often try to work with people who need to lower their medication costs. Neighborhood pharmacies may not have formal discount programs like the big chains offer, but they are usually willing to match or beat their competitor's prices.

Build & Buy Car Buying Service

Build & Buy Car Buying Service

Save thousands off MSRP with upfront dealer pricing information and a transparent car buying experience.

Get Ratings on the go and compare

Get Ratings on the go and compare

while you shop