How to Spend Your Leftover FSA Money

Use the last of these funds before time runs out and you lose them

When you shop through retailer links on our site, we may earn affiliate commissions. 100% of the fees we collect are used to support our nonprofit mission. Learn more.

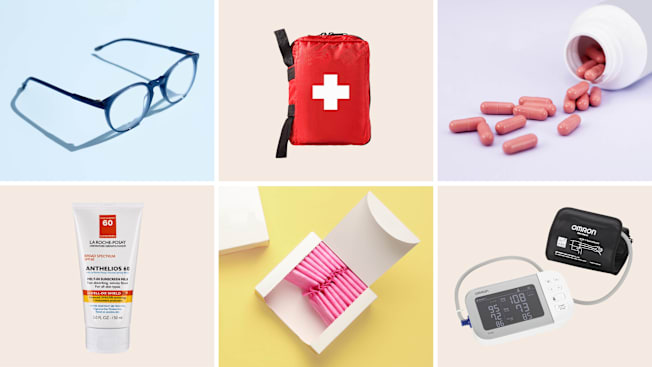

A flexible spending account (FSA) is a benefit offered by some employers. It allows people with workplace health insurance to set aside up to $3,300 in pretax dollars each year that can be spent on certain medical expenses, such as doctor or clinic visit copays, prescription drugs, some medical supplies and devices, out-of-pocket dental costs, and more. In the final month of the year, you might find you still have a bit of money left in your account.

The money in your FSA is use it or lose it, so you need to spend it by your plan’s cutoff. Many FSA plans have a hard deadline of Dec. 31, while others might allow you an additional two and a half months to empty the account or let you carry over up to $600 to the following year. If you’re unsure of your plan’s rules, check with your employer.

OTC Medications

Up through 2010, you could use your FSA money to purchase medications over-the-counter (OTC). The Affordable Care Act changed that rule, so that starting in 2011, you needed a doctor’s prescription in order to use your FSA for OTC drugs.

Thanks to the CARES Act, that’s no longer the case. So you can now use your FSA money for purchasing allergy medicine, the acetaminophen or ibuprofen you use to treat a headache or lower a fever, and more.

You can also use it for some supplements, but only if you have a letter of medical necessity from a doctor stating that the supplements are for the purposes of treating a medical condition (such as iron for anemia). FSA dollars can’t be used for vitamins or supplements intended for general health and wellness.

Medical Devices

Blood Pressure Monitors

Consumer devices meant to diagnose disease are usually approved for FSA reimbursement, and that includes blood pressure monitors. These can help your doctor diagnose hypertension if office tests suggest you might have it, and can help you keep an eye on your numbers if you’re taking blood pressure drugs. Here are a few of our top-rated ones.

Mobility Aids

FSA accounts can be used to cover the costs of purchasing or renting mobility devices such as canes, walkers, and wheelchairs (including wheelchair repairs). But paying for one of these devices out of pocket with your FSA dollars shouldn’t be your first step. Instead, get a prescription from your doctor, and find out whether your insurance covers at least part of the cost. Your FSA account can be used to pay for whatever insurance doesn’t cover. Check out our report to find out more about how to get the mobility device you need at the best price.

Pulse Oximeters and Thermometers

Thermometers and pulse oximeters, which can help you monitor certain vital signs for both acute and chronic illnesses, are both FSA eligible. Keep in mind that research suggests pulse oximeters may not be as accurate for people with darker skin tones. Here are a few of CR’s top-rated thermometers.

Hearing Aids

The cost of prescription hearing aids isn’t necessarily covered by insurance, including Medicare. But your FSA dollars can help defray at least some of the costs of aids if you need them.

You can also use your FSA to buy OTC hearing aids, which are often much cheaper than prescription aids, are available without the need to visit a doctor or audiologist, and are intended to help with self-perceived mild-to-moderate hearing loss.

Members can check out our ratings to find the best hearing aid brands.

Eyeglasses and Contact Lenses

If you have vision insurance, your policy may cover at least part of the cost of eyeglasses or contact lenses. But if the specs you want cost more than that or you want to buy a backup pair, you’ll have to make up the difference. And Medicare doesn’t cover any of the cost for eyeglasses or contact lenses unless they’re for corrective lenses following a cataract surgery and implantation of an intraocular lens.

Your FSA account, however, can be used to pay for glasses or contacts. A backup pair of frames or a pair of prescription sunglasses can be a great way to spend leftover dollars. CR members can view our ratings to find the best stores from which to buy eyeglasses and contact lenses.

Personal Care Products

Menstrual Products

This includes tampons, pads, liners, sponges, menstrual cups, and period underwear.

Sunscreen

Everyone should use sunscreen every day, even during the winter, and you can use your FSA dollars to stock up for the sunny months, too. To be covered, products must offer at least 15 SPF, but the American Academy of Dermatology recommends opting for a product with at least 30 SPF. See some of our top-rated picks, below.

OTC Acne Treatments

This includes acne facial cleansers, ointments and serums, pimple patches and masks, and light therapy acne treatment devices.

First Aid Supplies

Take a look at the first-aid kit you keep inside your home or car. Does it need to be restocked? You can use your FSA to pay for bandages and other first-aid items.

Pregnancy, Breastfeeding, and Family Planning Products

Certain items related to family planning, birth, pregnancy, and infant care can usually be purchased using FSA dollars.

Condoms, for example, can be purchased with your FSA (prescription birth control like contraceptive pills or IUDs is generally fully covered by insurance without a copay).

Other eligible items include pregnancy test kits, breast pumps (above and beyond what’s covered by insurance), and other lactation accessories (though not the cost of extra bottles for storage).

The account can also be used toward the cost of fertility treatments, as well as childbirth and breastfeeding classes.